S-1: General form for registration of securities under the Securities Act of 1933

Published on June 18, 2025

As filed with the Securities and Exchange Commission on June 17, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| LIXTE BIOTECHNOLOGY HOLDINGS, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 2834 | 20-2903526 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary standard industrial classification code number) |

(I.R.S. employer identification number) |

680 East Colorado Boulevard, Suite 180

Pasadena, CA 91101

(631) 830-7092

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Bastiaan van der Baan

Chief Executive Officer

680 East Colorado Boulevard, Suite 180

Pasadena, CA 91101

(631) 830-7092

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

David L. Ficksman, Esq. TroyGould PC 1801 Century Park East, 16th Floor Los Angeles, CA 90067 Tel: (310) 789-1290 |

Anthony W. Basch, Esq. Kaufman & Canoles Two James Center, 14th Floor Richmond, VA 23219 Tel: (804) 771-5700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the SEC is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated June 17, 2025

PRELIMINARY PROSPECTUS

5,263,158 Shares of Common Stock, and/or up to

5,263,158 Pre-Funded Warrants to purchase 5,263,158 Shares of Common Stock

(and 5,263,158 shares of Common Stock underlying the Pre-Funded Warrants)

LIXTE BIOTECHNOLOGY HOLDINGS, INC.

This is a firm commitment public offering of 5,263,158 shares of common stock (“Common Stock”) at an assumed public offering price of $1.14 per share of Common Stock, which is the last reported sales price of our Common Stock on the Nasdaq Capital Market on June 13, 2025.

The public offering price per share of Common Stock will be determined between us and the underwriter based on market conditions at the time of pricing, and may be at a discount to the then current market price of our common stock. Therefore, the recent market price of our common stock referenced throughout this preliminary prospectus may not be indicative of the final offering price per share of Common Stock.

Our common stock is listed on the Nasdaq Capital Market under the symbol “LIXT”. The closing price of our common stock on the Nasdaq Capital Market on June 13, 2025 was $1.14 per share.

We are also offering to investors in shares of Common Stock that would otherwise result in the investor’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering the opportunity to purchase pre-funded warrants (“Pre-Funded Warrants”) in lieu of Common Stock. Each Pre-Funded Warrant consists of one pre-funded warrant (“Pre-Funded Warrant”) to purchase one share of our common stock. The purchase price of each Pre-Funded Warrant is $1.13999 (which is equal to the assumed public offering price per share of Common Stock of $1.14 minus $0.00001). Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the common stock outstanding immediately after giving effect to such exercise. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Pre-Funded Warrant purchased, the number of shares of Common Stock will be decreased on a one-for-one basis. The Pre-Funded Warrants have no stand-alone rights and will not be certificated or issued as stand-alone securities.

We have engaged Spartan Capital Securities, LLC to act as our exclusive underwriter in connection with this offering, hereinafter referred to as the “underwriter” or “Spartan”.

There is no established trading market for the Pre-Funded Warrants and we do not expect an active trading market to develop. We do not intend to list the Pre-Funded Warrants on any securities exchange or other trading market. Without an active trading market, the liquidity of these securities will be limited.

Investing in our securities is speculative and involves a high degree of risk. You should carefully consider the risk factors beginning on page 16 of this prospectus before purchasing our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share of Common Stock | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriter discount(1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ |

| (1) | We have agreed to pay the underwriter a cash fee equal to 8.0% of the aggregate gross proceeds raised in this offering. We have also agreed to provide the underwriter with a 1.0% non-accountable expense allowance and to reimburse the underwriter for certain of its offering-related expenses, including its legal fees, up to a maximum of $125,000, which are not included in the above table. We have agreed to issue to the underwriter five-year warrants (the “Underwriter Warrants”) to purchase up to 5.0% of the number of shares of Common Stock and the over-allotment option at an exercise price of 125% of the offering price per share of Common Stock. See “Underwriting” for a description of the compensation to be received by the underwriter. |

We have granted the underwriter a 45-day option to purchase up to an additional 789,474 shares of Common Stock, representing 15% of the shares of Common Stock sold in the offering, at an assumed public offering price of $1.14 per share of Common Stock.

The underwriter is expected to deliver the Common Stock (and Pre-Funded Warrants, if any) on or about June __, 2025, subject to the satisfaction of customary closing conditions.

Sole Underwriter

Spartan Capital Securities, LLC

The date of this prospectus is June 17, 2025.

TABLE OF CONTENTS

| i |

You should rely only on the information contained in or incorporated by reference into this prospectus and in any free writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The sale of our securities will only be made in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, and any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of our securities.

We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside of the United States.

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

| 1 |

The following summary highlights information contained or incorporated by reference elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes and other documents incorporated by reference herein, as well as the information under the caption “Risk Factors” herein and under similar headings in the other documents that are incorporated by reference into this prospectus including documents that are filed after the date hereof. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements”. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections included in or incorporated by reference herein. In this prospectus, unless otherwise stated or the context otherwise requires, references to “Lixte”, the “Company”, “we”, “us”, “our”, or similar references mean Lixte Biotechnology Holdings, Inc.

Company Overview

We are a clinical-stage biopharmaceutical company focused on identifying new targets for cancer drug development and developing and commercializing cancer therapies. Our product pipeline is primarily focused on inhibitors of protein phosphatase 2A, which are used to enhance cytotoxic agents, radiation, immune checkpoint blockers and other cancer therapies. We believe that inhibitors of protein phosphatases have significant therapeutic potential for a broad range of cancers. We are focusing on the clinical development of a specific protein phosphatase inhibitor, referred to as LB-100, which has been shown to have clinical anti-cancer activity.

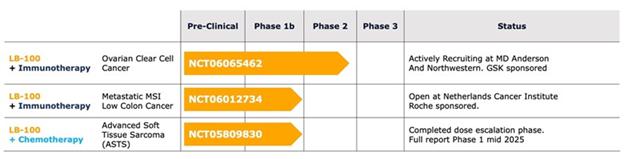

We believe that the mechanism by which LB-100 affects cancer cell growth is different from cancer agents currently approved for clinical use. LB-100 is currently being tested in clinical trials in Ovarian Clear Cell Carcinoma, Metastatic Micro Satellite Stable (MSS) Colon Cancer, and Advanced Soft Tissue Sarcoma. LB-100 has shown anti-cancer activity in animal models of glioblastoma multiforme, neuroblastoma, and medulloblastoma, all cancers of neural tissue. LB-100 has also been shown to enhance the effectiveness of commonly used anti-cancer drugs in animal models of melanoma, breast cancer and sarcoma. The enhancement of anti-cancer activity of these anti-cancer drugs occurs at doses of LB-100 that do not significantly increase toxicity in animals. It is therefore hoped that, when combined with standard anti-cancer regimens against many tumor types, LB-100 will improve therapeutic benefit.

As a compound moves through the FDA-approval process, it becomes an increasingly valuable property, but at a cost of additional investment at each stage. As the potential effectiveness of LB-100 has been documented at the clinical trial level, we have allocated resources to expand the breadth and depth of its patent portfolio. Our approach has been to operate with a minimum of overhead, moving compounds forward as efficiently and inexpensively as possible, and to raise funds to support each of these stages as certain milestones are reached. Our longer-term objective is to secure one or more strategic partnerships or licensing agreements with pharmaceutical companies with major programs in cancer.

Our activities are subject to significant risks and uncertainties, including the need for additional capital. We have not yet commenced any revenue-generating operations, does not have positive cash flows from operations, relies on stock-based compensation for a substantial portion of employee and consultant compensation, and is dependent on periodic access to equity capital to fund its operating requirements.

Description of Business

Most cancer patients are treated with either chemotherapy or immunotherapy or both. These therapies often have limited benefit and there is a high unmet medical need to enhance their effects. In many preclinical models we have shown that LB-100 enhances the effect of both chemotherapy and Immunotherapy

| 2 |

LB-100, a small molecule potent inhibitor of PP2A, was designed and developed by us. Numerous preclinical studies have documented that LB-100 potentiates most if not all anti-cancer drugs that damage DNA. LB-100 is not associated with any increase in cytotoxicity when given with cytotoxic drugs. This synergy involves transient interruption of several DNA damage repair pathways by LB-100 and an increase in cell division rate. LB-100 has FDA Investigational New Drug status in the US and Investigational Medicinal Product Dossier approval in the European Union.

In its initial Phase 1 clinical trial, LB-100 given alone daily for 3 days was non-toxic, except for a transient increase in serum creatinine believed to be caused by inhibition of PP2A in the renal tubules. In the Phase 1 clinical trial, the Maximum Tolerated Dose (“MTD”) was 2.33mg/m2 daily for 3 days every 3 weeks. Of the 25 patients with heavily-treated advanced solid tumors with measurable disease, 3 patients had stable disease for 2 cycles, 3 patients had stable disease for 4 cycles, and 3 patients had stable disease for 6 cycles. One patient with pancreatic cancer had a partial response after 12 cycles lasting 534 days.

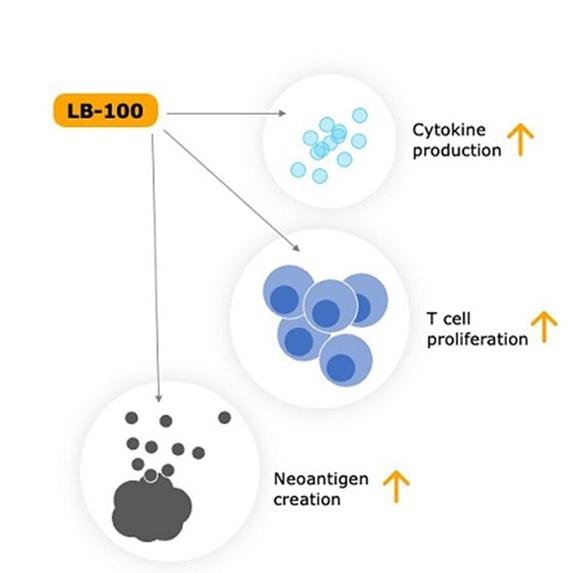

Low doses of LB-100 have now been shown to enhance immune checkpoint inhibition (“ICI”) by several different mechanisms affecting the tumor compartment and immune T-cell compartment. LB-100 increases CD8+T-cell infiltration and CD8-Treg ratio, CD8+T-cell proliferation, and cytokine production induces microsatellite instability, neoantigen production and immune responsiveness, converting immunologically “cold” to “hot” cancers.

| 3 |

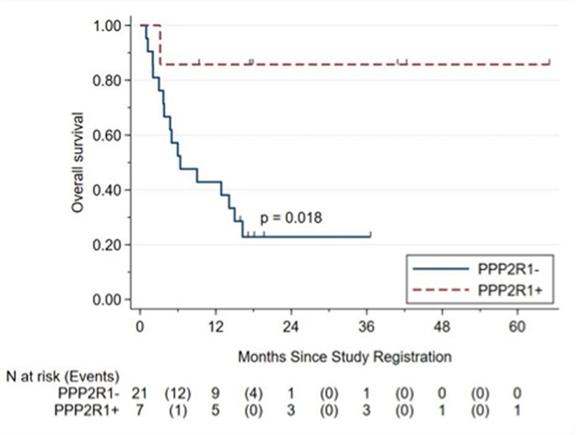

Ovarian clear cell carcinoma patients with inactivating mutations in PPP2R1A, a gene coding for a scaffold component of PP2A, and treated with immune checkpoint inhibitors, were recently found to have markedly longer survival than patients without the mutation in their cancers. Retrospective reviews of patients with a variety of cancers treated with ICI or chemotherapy show much longer survival of ICI-treated patients with a PPP2R1A mutation in their tumors.

| 4 |

Based on the observations in ovarian clear cell carcinoma, we have initiated a clinical trial in this disease combining LB-100 with a monoclonal antibody blocking PD-1, a protein found on T-cells (NCT06065462).

Given these preclinical and clinical observations, it is likely that LB-100 may be a general way to enhance immunotherapy responses.

The research on the LB-100 series was initiated in 2006 under a Cooperative Research and Development Agreement (“CRADA”) with the National Institute of Neurologic Disorders and Stroke or NINDS of the National Institutes of Health or NIH dated March 22, 2006 that was subsequently extended through a series of amendments until it terminated on April 1, 2013.

We have also designed and developed the LB-200 series, which consists of histone deacetylase inhibitors (HDACi). LB-200 has not advanced to the clinical stage and would require additional capital to fund further development. Accordingly, because of our focus on the clinical development of LB-100 and analogs for cancer therapy as described below in more detail, we have decided not to actively pursue the preclinical development of our LB-200 series of compounds at this time.

| 5 |

Clinical Trial Agreements

Spanish Sarcoma Group Collaboration Agreement

Effective July 31, 2019, we entered into a Collaboration Agreement for an Investigator-Initiated Clinical Trial with the Spanish Sarcoma Group (Grupo Español de Investigación en Sarcomas or “GEIS”), Madrid, Spain, to carry out a study entitled “Randomized phase I/II trial of LB-100 plus doxorubicin vs. doxorubicin alone in first line of advanced soft tissue sarcoma”. The purpose of this clinical trial is to obtain information with respect to the efficacy and safety of LB-100 combined with doxorubicin in soft tissue sarcomas. Doxorubicin is the global standard for initial treatment of advanced soft tissue sarcomas (“ASTS”). Doxorubicin alone has been the mainstay of first line treatment of ASTS for over 40 years, with little improvement in survival from adding cytotoxic compounds to or substituting other cytotoxic compounds for doxorubicin. In animal models, LB-100 consistently enhances the anti-tumor activity of doxorubicin without apparent increases in toxicity.

GEIS has a network of referral centers in Spain and across Europe that have an impressive track record of efficiently conducting innovative studies in ASTS. We agreed to provide GEIS with a supply of LB-100 to be utilized in the conduct of this clinical trial, as well as to provide funding for the clinical trial. The goal is to enter approximately 150 to 170 patients in this clinical trial over a period of two to four years. The Phase 1 portion of the study began in the quarter ended June 30, 2023 to determine the recommended Phase 2 dose of the combination of doxorubicin and LB-100. As advanced sarcoma is a very aggressive disease, the design of the Phase 2 portion of the study assumes a median progression-free survival (“PFS”), no evidence of disease progression or death from any cause) of 4.5 months in the doxorubicin arm and an alternative median PFS of 7.5 months in the doxorubicin plus LB-100 arm to demonstrate a statistically significant decrease in relative risk of progression or death by adding LB-100. There is a planned interim analysis of the primary endpoint when approximately 50% of the 102 events required for final analysis is reached.

On October 13, 2022, we announced that the Spanish Agency for Medicines and Health Products (Agencia Española de Medicamentos y Productos Sanitarios or “AEMPS”) had authorized a Phase 1b/randomized Phase 2 study of LB-100, our lead clinical compound, plus doxorubicin, versus doxorubicin alone, the global standard for initial treatment of advanced soft tissue sarcomas (ASTS). Consequently, this clinical trial commenced during the quarter ended June 30, 2023 and to be completed and a report prepared by December 31, 2026. In April 2023, GEIS completed its first site initiation visit in preparation for the clinical trial at Fundación Jiménez Díaz University Hospital (Madrid). Up to 170 patents will be entered into the clinical trial. The recruitment phase of the Phase 1b portion of the protocol was completed during the quarter ended September 30, 2024. We expect to have data on toxicity and preliminary efficacy from this portion of the clinical trial during the quarter ending December 31, 2025.

Given the focus on the combination of LB-100 with immunotherapy in ovarian clear cell carcinoma and colorectal cancer and the availability of capital resources, we entered into Amendment No. 1 to the Collaboration Agreement effective March 11, 2025 that relieved us of the financial obligation to support the randomized Phase 2 portion of the clinical trial contemplated in the Collaboration Agreement of approximately $3,095,000. As a result, it is uncertain as to whether the Phase 2 portion of this clinical trial will proceed.

Clinical Research Support Agreement Relating to Small Cell Lung Cancer

We had executed a Clinical Research Support Agreement with the City of Hope National Medical Center to carry out a Phase 1b clinical trial of LB-100 combined with an FDA-approved standard regiment for treatment of untreated extensive-stage disease small cell lung cancer. The clinical trial was initiated on March 9, 2021. However, due to the lack of patient accrual, the Company provided notice to the City of Hope National Medical Center of our intent to terminate the Clinical Research Support Agreement effective as of July 8, 2024.

| 6 |

MD Anderson Cancer Center Clinical Trial

On September 20, 2023, we announced an investigator-initiated Phase 1b/2 collaborative clinical trial to assess whether adding LB-100 to a human programmed death receptor-1 (“PD-1”) blocking antibody of GSK plc (“GSK”), dostarlimab-gxly, may enhance the effectiveness of immunotherapy in the treatment of ovarian clear cell carcinoma (“OCCC”). The clinical trial is being sponsored by The University of Texas MD Anderson Cancer Center (“MD Anderson”) and is being conducted at The University of Texas – MD Anderson Cancer Center. We are providing LB-100 and GSK is providing dostarlimab-gxly and financial support for the clinical trial. On January 29, 2024, we announced the entry of the first patient into this clinical trial. We currently expect that this clinical trial will be completed by December 31, 2027.

On February 25, 2025, we announced that we had added the Robert H. Lurie Comprehensive Cancer Center (Lurie Cancer Center) of Northwestern University as a second site in a clinical trial combining the Company’s proprietary compound LB-100 with GSK’s dostarlimab to treat ovarian clear cell cancer. Patient recruitment is underway, and the first patient has been dosed.

Netherlands Cancer Institute Clinical Trial

Effective June 10, 2024, we entered into a Clinical Trial Agreement with the Netherlands Cancer Institute (“NKI”) to conduct a Phase 1b clinical trial of the Company’s protein phosphatase inhibitor, LB-100, combined with atezolizumab, a PD-L1 inhibitor, the proprietary molecule of F. Hoffman-La Roche Ltd. (“Roche”), for patients with microsatellite stable metastatic colon cancer. Under the agreement, we will provide our lead clinical compound, LB-100, and under a separate agreement between NKI and Roche, Roche will provide atezolizumab and financial support for the clinical trial. We have no obligation to and will not provide any reimbursement of clinical trial costs. Pursuant to the agreement and the protocol set forth in the agreement, the clinical trial will be conducted by NKI at NKI’s site in Amsterdam by principal investigator Neeltje Steeghs, MD, PhD, and NKI will be responsible for the recruitment of patients. The agreement provides for the protection of the respective intellectual property rights of each of Lixte, NKI and Roche.

This Phase 1b clinical trial will evaluate safety, optimal dose and preliminary efficacy of LB-100 combined with atezolizumab for the treatment of patients with metastatic microsatellite stable colorectal cancer. Immunotherapy using monoclonal antibodies like atezolizumab can enhance the body’s immune response against cancer and hinder tumor growth and spread. LB-100 has been found to improve the effectiveness of anticancer drugs in killing cancer cells by inhibiting a protein called PP2A on cell surfaces. Blocking PP2A increases stress signals in tumor cells expressing the PP2A protein. Accordingly, combining atezolizumab with LB-100 may enhance treatment efficacy for metastatic colorectal cancer, as cancer cells with heightened stress signals are more vulnerable to immunotherapy.

This study comprises a dose escalation phase and a dose expansion phase. The objective of the dose escalation phase is to determine the recommended Phase 2 dose (RP2D) of LB-100 when combined with the standard dosage of atezolizumab. The dose expansion phase will further investigate the preliminary efficacy, safety, tolerability, and pharmacokinetics/dynamics of the LB-100 and atezolizumab combination. The clinical trial opened in August 2024 with the enrollment of the first patient. Patient accrual is expected to take up to 24 months, with a maximum of 37 patients with advanced colorectal cancer to be enrolled in this study.

The shelf life of the batch of LB-100 being utilized in this clinical trial was scheduled to expire on December 25, 2025, but has been extended for a final time for a period of 12 months through December 25, 2026, after which date no new patients can be recruited into this clinical trial and no patients can be treated with the current batch of LB-100. Although we do not currently intend to commission the production of a new batch of LB-100 for this clinical trial, we believe that it is likely that we will be able to recruit enough patients in sufficient time into this clinical trial to be able to reach an evaluable outcome for all end points in this clinical trial by December 25, 2026. The expiration of the shelf life of this batch of LB-100 represents an effective termination date of this clinical trial.

The principal investigator of the colorectal study testing LB-100 in combination with atezolizumab is currently investigating two Serious Adverse Events (“SAEs”) observed in the clinical trial that was launched in August 2024. The Investigational Review Board (IRB) of the Netherlands Cancer Institute has requested additional information with respect to these SAEs and the study has been paused for enrollment until the IRB’s questions have been, as more fully discussed below at “Risks Related to the Development and Regulatory Approval of Our Product Candidates - A clinical trial hold due to serious adverse events could delay or halt the development of our product candidate”.

| 7 |

National Cancer Institute Pharmacologic Clinical Trial

In May 2019, the National Cancer Institute (NCI) initiated a glioblastoma (GBM) pharmacologic clinical trial. This study was being conducted and funded by the NCI under a Cooperative Research and Development Agreement, with the Company being required to provide the LB-100 clinical compound.

Primary malignant brain tumors (gliomas) are very challenging to treat. Radiation combined with the chemotherapeutic drug temozolomide has been the mainstay of therapy of the most aggressive gliomas (glioblastoma multiforme or GBM) for decades, with little further benefit gained by the addition of one or more anti-cancer drugs, but without major advances in overall survival for the majority of patients. In animal models of GBM, the Company’s novel protein phosphatase inhibitor, LB-100, has been found to enhance the effectiveness of radiation, temozolomide chemotherapy treatments and immunotherapy, raising the possibility that LB-100 may improve outcomes of standard GBM treatment in the clinic. Although LB-100 has proven safe in patients at doses associated with apparent anti-tumor activity against several human cancers arising outside the brain, the ability of LB-100 to penetrate tumor tissue arising in the brain was not known. Many drugs potentially useful for GBM treatment do not enter the brain in amounts necessary for anti-cancer action.

The NCI study was designed to determine the extent to which LB-100 enters recurrent malignant gliomas. Patients having surgery to remove one or more tumors received one dose of LB-100 prior to surgery and had blood and tumor tissue analyzed to determine the amount of LB-100 present and to determine whether the cells in the tumors showed the biochemical changes expected to be present if LB-100 reached its molecular target. As a result of the innovative design of the NCI study, it was believed that data from a few patients would be sufficient to provide a sound rationale for conducting a larger clinical trial to determine the effectiveness of adding LB-100 to the standard treatment regimen for GBMs. Blood and brain tumor tissue were analyzed from seven patients after intravenous infusion of a single dose of LB-100. Results of the investigation demonstrated that there was virtually no entry of LB-100 into the brain tumor tissue. Accordingly, alternative methods of drug delivery will be required to determine if LB-100 has meaningful clinical anti-cancer activity against glioblastoma multiforme and other aggressive brain tumors.

Patent and License Agreements

National Institute of Health

Effective February 23, 2024, we entered into a Patent License Agreement (the “License Agreement”) with the National Institute of Neurological Disorders and Stroke (“NINDS”) and the National Cancer Institute (“NCI”), each an institute or center of the National Institute of Health (“NIH”). Pursuant to the License Agreement, we have licensed exclusively NIH’s intellectual property rights claimed for a Cooperative Research and Development Agreement (“CRADA”) subject invention co-developed with the Company, and the licensed field of use, which focuses on promoting anti-cancer activity alone, or in combination with standard anti-cancer drugs. The scope of this clinical research extends to checkpoint inhibitors, immunotherapy, and radiation for the treatment of cancer. The License Agreement is effective, and shall extend, on a licensed product, licensed process, and country basis, until the expiration of the last-to-expire valid claim of the jointly owned licensed patent rights in each such country in the licensed territory, unless sooner terminated.

The License Agreement contemplates that we will seek to work with pharmaceutical companies and clinical trial sites (including comprehensive cancer centers) to initiate clinical trials within timeframes that will meet certain benchmarks. Data from the clinical trials will be the subject of various regulatory filings for marketing approval in applicable countries in the licensed territories. Subject to the receipt of marketing approval, we would be expected to commercialize the licensed products in markets where regulatory approval has been obtained.

Other Significant Agreements and Contracts

Netherlands Cancer Institute

| 8 |

On October 8, 2021, we entered into a Development Collaboration Agreement with the Netherlands Cancer Institute, Amsterdam (“NKI”), one of the world’s leading comprehensive cancer centers, and Oncode Institute, Utrecht, a major independent cancer research center, for a term of three years. The Development Collaboration Agreement was subsequently modified by Amendment No. 1 thereto.

The Development Collaboration Agreement is a preclinical study intended to identify the most promising drugs to be combined with LB-100, and potentially LB-100 analogues, to be used to treat a range of cancers, as well as to identify the specific molecular mechanisms underlying the identified combinations. We agreed to fund the preclinical study, at an approximate cost of 391,000 Euros and provide a sufficient supply of LB-100 to conduct the preclinical study.

On October 3, 2023, we entered into Amendment No. 2 to the Development Collaboration Agreement with NKI, which provides for additional research activities, extends the termination date of the Development Collaboration Agreement by two years to October 8, 2026, and added 500,000 Euros to the operating budget being funded by us.

On October 4, 2024, we entered into Amendment No. 3 to the Development Collaboration Agreement with NKI, which suspended Amendment No. 2 and provided for a new study term of one year and starts upon the dosing of the first patient in the clinical trial at a project cost of 100,000 Euros.

Effective as of June 15, 2022, Dr. René Bernards was appointed to our Board of Directors as an independent director. Dr. Bernards is a leader in the field of molecular carcinogenesis and is employed by NKI.

Intellectual Property

Our intellectual property includes proprietary know-how, proprietary methodologies and extensive clinical validation data and publications. To provide legal protection of our intellectual property, we rely on a combination of patents, licenses, trade secrets, trademarks, confidentiality and non-disclosure clauses and agreements, and other forms of intellectual property protection to define and protect our rights to our products.

Our products are expected to be covered by our patents. These patents now cover sole rights to the composition and synthesis of our LB-100 series of drugs, which is the Company’s lead clinical compound in development. Lixte has filed patent applications covering the treatment of cancer with LB-100. Lixte has also filed joint patent applications with the NIH and the Netherlands Cancer Institute for the treatment of cancer using LB-100 in combination with other drugs like immune checkpoint inhibitors and WEE1 inhibitors (a class of drugs that target and inhibit the WEE1 kinase enzyme that plays a crucial role in regulating cell division).

Patent applications for the LB-100 series (oxabicycloheptanes and oxabicycloheptenes) have been filed in the United States and internationally under the Patent Cooperation Treaty. Patents for composition of matter and for several uses of the LB-100 series have been issued in the United States, Mexico, Australia, Japan, China, Hong Kong, Canada, and by the European Patent Office

We strive to protect and enhance the proprietary technology, inventions, and improvements that are commercially important to the development of our business, including seeking, maintaining, and defending its patent rights, which are owned solely by our wholly-owned Delaware subsidiary, Lixte Biotechnology, Inc., except in several instances jointly with one of many of our collaborators. We also rely on trade secrets relating to its proprietary pipeline of product candidates and on know-how and continuing technological innovation to develop and strengthen its pipeline. We intend to rely on regulatory protection afforded by regulatory agencies through data exclusivity, market exclusivity, and patent term extensions, where available.

Our success will depend in large part on its ability to obtain and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to its business; defend and enforce its patents; preserve the confidentiality of its trade secrets; and operate without infringing valid and enforceable patents or proprietary rights of third parties. Our ability to stop third parties from making, using, selling, offering to sell, or importing our technology may depend on the extent to which we have rights under valid and enforceable licenses, patents, or trade secrets that cover these activities. In some cases, enforcement of these rights may depend on cooperation of the joint owners of our jointly owned patents and patent applications.

| 9 |

With respect to both our solely and jointly owned intellectual property, we cannot be sure that patents will be granted on any of its pending patent applications or on any patent applications filed solely or jointly by us in the future; we cannot be sure that any of our existing patents or any patents that may be granted to us in the future will be commercially useful in protecting our intended commercial products or therapeutic methods; and we cannot be sure that an agency or court would determine that the our solely or jointly owned patents are valid and enforceable.

Nasdaq Compliance

On August 19, 2024, we received a letter from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC indicating that we were not in compliance with the minimum stockholders’ equity requirement of $2,500,000 for continued listing on the Nasdaq Capital Market under Listing Rule 5550(b) (the “Equity Rule”).

On October 3, 2024, we submitted a plan to the Staff to regain compliance with the Equity Rule, which outlined our proposed initiatives to regain compliance by raising equity capital through various registered equity offerings.

On October 21, 2024, the Staff provided notice to us that it had granted an extension through February 18, 2025 to regain compliance with the Equity Rule.

As of February 18, 2025, we had not regained compliance with the Equity Rule. Accordingly, on February 19, 2025, we received a Staff determination letter from the Staff stating that we did not meet the terms of the extension because we did not complete our proposed financing initiatives to regain compliance. We timely requested a Hearing before a Nasdaq Hearings Panel (the “Panel”), which automatically stayed Nasdaq’s suspension or delisting of our Common Stock and public warrants pending the Panel’s decision.

On April 17, 2025, we received notice that the Panel had granted us an extension in which to regain compliance with all continued listing rules of the Nasdaq Capital Market. The Panel’s determination followed a hearing on April 3, 2025, at which time the Panel considered our plan to regain compliance with the Equity Rule. As a result of the extension, the Panel granted our request for continued listing on the Nasdaq Capital Market, provided that we demonstrate compliance with the Equity Rule and all other continued listing requirements for the Nasdaq Capital Market by July 3, 2025.

This offering is being conducted in order for us to satisfy the decision of the Panel and to provide the working capital resources to fund our operations. However, there can be no assurances that the Panel will deem the proceeds from this offering as sufficient to comply with the Equity Rule and all other continued listing requirements for the Nasdaq Capital Market. Accordingly, even if we complete this offering, there can be no assurances that we will be able to regain compliance during the extension period and thus be able to maintain our listing on the Nasdaq Capital Market.

During the extension period, our Common Stock and public warrants will continue to trade on the Nasdaq Capital Market.

Corporate Information

We were incorporated as a Delaware Corporation on May 24, 2005 under the name SRKP7, Inc. On June 30, 2006, pursuant to a share exchange agreement, we acquired all of the outstanding shares of Lixte Biotechnology, Inc. which then became a wholly owned subsidiary. On December 7, 2006, we changed our name to Lixte Biotechnology Holdings, Inc.

Effective September 26, 2023, Bastiaan van der Baan, a director of the Company since June 17, 2022, replaced our founder, John S. Kovach, as President and Chief Executive Officer. Dr. Kovach passed away on October 5, 2023. Effective October 6, 2023, Mr. van der Baan was appointed as Chairman of the Board of Directors.

| 10 |

As discussed below, effective June 16, 2025, Mr. van der Baan resigned as Chairman of the Board of Directors and Chief Executive Officer, but remained as President and as a member of the Board of Directors, and was appointed as the Company’s Chief Scientific Officer, and Geordan Pursglove was appointed as Chairman of the Board of Directors and Chief Executive Officer.

Our common stock and public warrants are traded on the Nasdaq Capital Market under the symbols “LIXT” and “LIXTW”, respectively. On June 2, 2023, we effected a one-for-ten reverse split of our outstanding shares of common stock in order to remain in compliance with the $1.00 minimum closing bid price requirement of the Nasdaq Capital Market.

Our principal address is 680 East Colorado Boulevard, Suite 180, Pasadena, CA 91101. Our telephone number is (631) 830-7092. We maintain a website at https://lixte.com. The information contained on our website is not, and should not be interpreted to be, incorporated into this prospectus.

July 2023 Financing

On July 20, 2023, we sold 583,334 shares of common stock at a price of $6.00 per share to an institutional investor and raised gross proceeds of approximately $3,500,000. As part of this financing, we sold warrants to the institutional investor to purchase 583,334 shares of common stock (the “2023 Warrants”). The 2023 Warrants had an initial exercise price of $6.00 per share, were immediately exercisable upon issuance, and expire five years thereafter on July 20, 2028. We also issued warrants to the placement agent to purchase 35,000 shares of common stock at an exercise price of $6.60 per share and expiring on July 20, 2028 (the “2023 Placement Agent Warrants”).

The exercise prices of the warrants issued to the institutional investor and to the placement agent are subject to customary adjustments for stock splits, stock dividends, stock combinations, reclassifications, reorganizations, or similar events affecting our common stock. In addition, the warrants issued to the institutional investor contain a “fundamental transaction” provision whereby in the event of a fundamental transaction (including a sale or transfer of assets or ownership of the Company as defined in the warrant agreement) within our control, the holder of the unexercised common stock warrants would be entitled to receive, in exchange for extinguishment of the warrants, cash consideration equal to a Black-Scholes valuation, as defined in the warrant agreement. If such fundamental transaction is not within our control, the warrant holder would only be entitled to receive the same form of consideration (and in the same proportion) as the holders of our common stock.

Accordingly, in the event of a change in control of the Company or a sale or transfer of all or substantially all of our assets, as defined in the 2023 Warrants, to the extent that the warrants issued to the institutional investor are outstanding at the effective date that such a transaction is closed, this “fundamental transaction” provision would entitle the holder to substantial cash consideration, thus reducing the amounts to be retained by us or potentially distributable to our stockholders.

February 2025 Financing

On February 11, 2025, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with two institutional investors (the “Selling Stockholders”). Pursuant to the Purchase Agreement, on February 13, 2025, we sold 434,784 shares of common stock at a price of $2.415 per share and raised gross proceeds of approximately $1,050,000. As part of this financing, we sold warrants to the institutional investors to purchase 434,784 shares of common stock (the “2025 Warrants”). Such Warrants had an initial exercise price of $2.29 per share, were immediately exercisable upon issuance, and expire five years thereafter on February 12, 2030. We also issued warrants to the placement agent to purchase 32,609 shares of common stock at an exercise price of $3.0188 per share and expiring on February 12, 2030 (the “2025 Placement Agent Warrants”).

The exercise prices of the warrants issued to the institutional investors and to the placement agent are subject to customary adjustments for stock splits, stock dividends, stock combinations, reclassifications, reorganizations, or similar events affecting our common stock. In addition, the warrants issued to the institutional investors contain a “fundamental transaction” provision whereby in the event of a fundamental transaction (including a sale or transfer of assets or ownership of the Company as defined in the warrant agreement) within our control, the holders of the unexercised common stock warrants would be entitled to receive, in exchange for extinguishment of the warrants, cash consideration equal to a Black-Scholes valuation, as defined in the warrant agreement. If such fundamental transaction is not within our control, the warrant holders would only be entitled to receive the same form of consideration (and in the same proportion) as the holders of our common stock.

| 11 |

Accordingly, in the event of a change in control of the Company or a sale or transfer of all or substantially all of our assets, as defined in the 2025 Warrants, to the extent that the warrants issued to the institutional investors are outstanding at the effective date that such a transaction is closed, this “fundamental transaction” provision would entitle the holders to substantial cash consideration, thus reducing the amounts to be retained by us or potentially distributable to our stockholders.

Executive Management and Director Changes

Prior to and effective as of the consummation of this public offering, there will be several changes with respect to our executive management and the Board of Directors as described herein.

Bastiaan van der Baan. Effective June 16, 2025, Bastiaan van der Baan resigned as Chairman of the Board of Directors and as Chief Executive Officer, but remained as President and as a member of the Board of Directors, and was appointed as Chief Scientific Officer. Mr. van der Baan’s principal responsibility as President will be related to the clinical development of our LB-100 lead compound. His responsibility as Chief Scientific Officer (CSO) will be for shaping and executing the scientific vision and research and development strategy of the Company, with a focus on discovering and developing innovative cancer therapeutics. The CSO leads all research functions, oversees preclinical and translational programs, supervises the Chief Medical Officer, and ensures alignment with clinical and regulatory development goals. The CSO provides scientific leadership to internal teams and external partners, supports fundraising and business development, and serves as a key member of executive management.

In conjunction with such resignation, the stock option that Mr. van der Baan was previously granted on September 26, 2023 to acquire 250,000 shares of common stock was deemed fully vested effective with Mr. van der Baan’s resignation as described herein, and the time period for Mr. van der Baan to exercise his stock option at any time in the future that he is no longer providing his services to the Company as a consultant, employee or otherwise was increased from ninety (90) days to one (1) year.

Except for the previously described changes in Mr. van der Baan’s management duties and the modifications to the terms of the stock option, Mr. van der Baan’s three (3) year employment agreement dated September 26, 2023 will remain in full force and effect.

If the Company does not complete a successful financing that enables it to maintain its listing on the Nasdaq Small Cap Market by July 3, 2025, the amendment to Mr. van der Baan’s employment agreement as described herein will be automatically terminated retroactive to the amendment date and Mr. van der Baan will be reinstated as Chairman of the Board of Directors and Chief Executive Officer.

Geordan Pursglove. Effective June 16, 2025, Geordan Pursglove was appointed as our new Chairman of the Board of Directors and Chief Executive Officer. His responsibilities include the oversight of our business operations and strategic planning, and he will be the primary contact between our executive team and the Board of Directors. He will also be the principal spokesperson of the Company and have final say on all corporate matters, subject only to the authority of the Board of Directors.

We have entered into an employment agreement with Mr. Pursglove for a term of three (3) years effective June 16, 2025. Mr. Pursglove will receive an annual salary of $240,000 which may be increased from time to time in the sole discretion of the Board of Directors. At his election, his compensation will be payable in cash and/or restricted shares, or a combination thereof.. He is also eligible to receive an annual bonus as determined in the sole discretion of the Board of Directors in the form of cash or equity, or a combination thereof. Mr. Pursglove will not receive any additional compensation for serving as the Chairman of the Board of Directors of the Company.

Effective as of the end of the first trading day for the Company’s common stock immediately following the consummation of this offering, as an inducement to Mr. Pursglove to join our Company, as a signing bonus, he will be granted a stock option to purchase 350,000 shares of our common stock at an exercise price equal to the closing price on the Nasdaq Stock Market on such date, which shall be exercisable for a term of five (5) years, shall provide for cashless exercise, and shall vest 50% on the grant date, 25% on September 30, 2025, and 25% on December 31, 2025, subject to continued service.

| 12 |

The stock option grant will not be issued under the Company’s 2020 Stock Incentive Plan. The stock option agreement will provide for certain registration rights (including on Form S-8) and for accelerated vesting upon the occurrence of certain events, including early termination of the employment agreement that is not the result of the voluntary termination, gross negligence or willful misconduct of Mr. Pursglove, a sale or change in control of the Company, or a sale, licensing or other disposition of all or substantially all of the assets of the Company, as defined in such stock option agreement.

If the Company does not complete a successful financing that enables it to maintain its listing on the Nasdaq Capital Market by July 3, 2025, the employment agreement with Mr. Pursglove as described herein will be deemed automatically terminated retroactively as of June 16, 2025 and the stock option grant will be cancelled, and Mr. Pursglove will promptly resign from the Board of Directors. In such event, Mr. van der Baan will be reinstated as Chairman of the Board of Directors and Chief Executive Officer.

Prior to joining the Company, Mr. Pursglove served as President, Chief Executive Officer and Chairman of the Board of Directors at Beyond Commerce, Inc. He was also President of Service 800, Inc., a leading phone and online customer satisfaction survey service that provides the most actionable customer feedback, to the most recognizable Fortune 500 companies globally, in which he led operations, scaled revenue, and oversaw the company’s strategic vision. Mr. Pursglove held a board position at SemiCab Holdings, an emerging leader in the global logistics and distribution industry that was part of Algorhythm Holdings (NASDAQ: RIME). Currently Mr. Pursglove serves as the managing director of The 2GP Group LLC. During his time as the Managing Director of The 2GP Group, Mr. Pursglove has built multiple businesses in Sports, Sales, Marketing and Logistics. Mr. Pursglove has over a decade of experience in M&A, public markets space, capital raising, funding, growth, scaling businesses and driving innovation.

Peter Stazzone. Effective upon the closing of the public offering, Peter Stazzone will be appointed as a member of the Board of Directors and as the Chair of the Audit Committee, replacing Regina Brown, the current Chair of the Audit Committee, who will resign from the Board of Directors effective upon Mr. Stazzone’s appointment. Mr. Stazzone is a senior finance and business development executive with over 20 years of experience in finance and operations management within start-ups, high-growth and multi-billion dollar organizations. Mr. Stazzone is an experienced board member in both the public and non-profit sectors. He earned his Master of Business Administration (Finance) from DePaul University and his Bachelor of Science (Accounting) from the University of Illinois. He also is a member of the American Institute of Certified Public Accountants. From 2021 to the present, Mr. Stazzone has acted as the Chief Financial Officer of Beyond Commerce, Inc., a publicly traded company operating in the Business-to-Business Internet Marketing Technology and Services, electric vehicles and logistics markets. From 2016 to 2021, Mr. Stazzone was the Chief Financial Officer of Strainz, Inc., a leading cannabis brand and manufacturing company operating in Colorado, Washington, and Nevada.

| 13 |

| Issuer: | Lixte Biotechnology Holdings, Inc. | |

| Securities offered by us: |

5,263,158 shares of Common Stock

We are also offering to investors in shares of Common Stock that would otherwise result in the investor’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering the opportunity to purchase Pre-Funded Warrants in lieu of Common Stock. Each Pre-Funded Warrant consists of one pre-funded warrant (“Pre-Funded Warrant”) to purchase one share of our common stock. The purchase price of each Pre-Funded Warrant is $1.13999 (which is equal to the assumed public offering price per share of Common Stock of $1.14 minus $0.00001). Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the common stock outstanding immediately after giving effect to such exercise. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Pre-Funded Warrant purchased, the number of Common Stock we are offering will be decreased on a one-for-one basis. The Pre-Funded Warrants have no stand-alone rights and will not be certificated or issued as stand-alone securities.

|

|

| Over-Allotment Option: | The offering is being underwritten on a firm commitment basis. We have granted the underwriter a 45-day option to purchase up to an additional 789,474 shares of Common Stock, representing 15% of the shares of Common Stock sold in the offering, at an assumed public offering price of $1.14 per share of Common Stock. | |

| Underwriter Warrants: |

We have also granted the underwriter five-year warrants to purchase up to 5.0% of the shares of Common Stock and Pre-Funded Warrants including in the over-allotment option at an exercise price of 125% of the offering price per share of Common Stock. The Underwriter Warrants may not be exercised, sold, transferred, assigned, pledged or hypothecated, or be the subject of any hedging, short sale, derivative, put, or call transaction that would result in the effective economic disposition of such securities for a period of one hundred eighty (180) days beginning on the commencement of sales of the offering.

|

|

| Assumed public offering price: | $1.14 per share of Common Stock, which is the closing price of our common stock on the Nasdaq Capital Market on June 13, 2025. | |

| Common stock outstanding immediately prior to this offering: | 2,756,991 shares of common stock. | |

| Common stock to be outstanding immediately after this offering: | 8,020,149 shares(1) of our common stock (or 8,809,623 shares of common stock if the over-allotment option is exercised in full) assuming no issuance of Pre-Funded Warrants, and no exercise of any of the Underwriter Warrants issued in this offering). | |

| Use of proceeds: | We currently intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds”. |

| 14 |

| Underwriting: | Spartan proposes to offer the shares of Common Stock purchased pursuant to the underwriting agreement between us and Spartan to the public at the public offering price set forth on the cover page of this prospectus. In addition, we will reimburse Spartan for certain out-of-pocket expenses, including legal fees, related to the offering up to a maximum of $125,000. See “Underwriting”. | |

| Nasdaq Capital Market trading symbol: | Our common stock currently trades on the Nasdaq Capital Market under the symbol “LIXT”. We do not intend to list the Pre-Funded Warrants offered hereunder on any stock exchange. | |

| Transfer agent and registrar: | The transfer agent and registrar for our common stock is Computershare Trust Company, N.A. | |

| Risk factors: | The securities offered by this prospectus are speculative and involve a high degree of risk. Investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors”. |

| (1) | Immediately after this offering, the Company will have 8,020,149 shares of common stock outstanding as set forth above, assuming that the underwriter over-allotment option is not exercised, and will exclude: |

| ● | 662,078 shares of common stock issuable upon the exercise of common stock options issued to members of management, consultants and directors at a weighted average exercise price of $11.526 per share; | |

| ● | 1,275,758 shares of common stock issuable upon exercise of outstanding common stock warrants at an average exercise price of $11.254 per share of common stock, including 434,784 shares of common stock issuable upon exercise of 434,784 common stock warrants exercisable at $2.29 per share issued in our February 13, 2025 offering, 32,609 shares of common stock issuable upon exercise of 32,609 common stock warrants exercisable at $3.1088 per share issued to the placement agent in our February 13, 2025 offering, and 149,700 shares of common stock issuable upon exercise of 149,700 publicly traded warrants at $57.00 per share of common stock through November 30, 2025; | |

| ● | 133,339 shares of common stock reserved for future grants pursuant to our 2020 Stock Incentive Plan, as amended (the “2020 Plan”); and | |

| ● | 263,158 shares of common stock issuable upon exercise of the Underwriter Warrants at an exercise price of $1.425 per share of common stock issuable to the underwriter in this offering, assuming that the over-allotment option is not exercised. |

Unless otherwise indicated, this prospectus also assumes no sale of Pre-Funded Warrants, no exercise of any of the Underwriter Warrants, and no exercise of the underwriter over-allotment option.

| 15 |

Investing in our common stock is highly speculative and involves a significant degree of risk. You should carefully consider the following risks and uncertainties as well as the risks and uncertainties described in the section entitled “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and in our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2025, filed with the Securities and Exchange Commission, which filings are incorporated in this prospectus by reference in their entirety, as well as in any prospectus supplement hereto. These risk factors could materially and adversely affect our business, results of operations or financial condition. Our business faces significant risks and the risks described below or incorporated by reference herein may not be the only risks we face. Additional risks not presently known to us or that we currently believe are immaterial may materially affect our business, results of operations, or financial condition. If any of these risks occur, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related to the Development and Regulatory Approval of Our Product Candidates

A clinical trial hold due to serious adverse events could delay or halt the development of our product candidate.

Our lead drug candidate, LB-100, is currently undergoing various clinical trials, and there is a risk that one or more of these trials could be placed on hold by regulatory authorities due to serious adverse events (SAEs) related to our drug candidate or to another company’s drug used in combination in one of our clinical trials. It is possible that the SAEs could be attributable to our drug candidate and could include, but not be limited to, unexpected severe side effects, treatment-related deaths, or long-term health complications. A dose given could result in non-tolerable adverse events defined as dose-limiting toxicity (DLT). When two DLTs occur at the same dose-level that dose-level is considered too high and unsafe. Further treatment is only allowed at lower dose-levels that have previously been found safe.

If an SAE or a pattern of SAEs is observed during the course of a clinical trial involving our drug candidate, the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), or other regulatory authorities may issue a clinical hold, requiring us to pause or discontinue further enrollment and dosing in our clinical trial. It is also possible that the clinical trial could be terminated. Any of these actions could delay or halt the development of our drug candidate, increase development costs, and negatively impact our ability to ultimately achieve regulatory approval. Additionally, if an SAE is confirmed to be drug-related, we may be required to conduct additional studies, modify the study design, or abandon further development of the drug candidate altogether, which could materially impact our business, financial condition, and prospects.

The occurrence of an SAE and any resulting clinical hold could also harm our reputation with patients, physicians, health institutions, and investors, diminish our ability to attract clinical trial participants, and damage our ability to interest investors and obtain financing in the future. There can be no assurances that we will not experience such SAEs in the future or that any related clinical hold will be lifted in a timely manner, or at all.

The principal investigator of the colorectal study testing LB-100 in combination with atezolizumab (Roche PD-L1 inhibitor) is currently investigating two SAEs observed in the clinical trial that was launched in August 2024. The Institutional Review Board (the “IRB”) of the Netherlands Cancer Institute (“NKI”) has put the colorectal cancer study on hold. The adverse reactions that developed in the two patients were dyspnea (shortness of breath) due to lung toxicity possibly or probably related to the combination of LB-100 and atezolizumab in one patient and fever and aphasia possibly or probably related to the combination of LB-100 and atezolizumab in the second patient. The patient who developed lung toxicity deceased due to the combination of lung metastases of colorectal cancer and dyspnea. The patient with fever and aphasia fully recovered from the adverse events with supportive medication.

Given the identified adverse events in the two patients in the clinical trial, the IRB requested from the principal investigator of the study at the NKI information as to whether the adverse events could have been caused by the combination of LB-100 and atezolizumab and information about the mode of action of the combination of LB-100 and atezolizumab. The principal investigator prepared a response to the IRB detailing the safety experience with LB-100 given alone and in combination with other cancer drugs, especially doxorubicin and dostarlimab. Doxorubicin is a well-known chemotherapy, and dostarlimab is a well-known immunotherapy of which the mode of action is closely related to that of atezolizumab.

| 16 |

The reported adverse events in the colorectal cancer study have not been seen in any other patients thus far treated with LB-100 alone or in combination with other cancer drugs. Through May 2025, the Company has been informed that a total of 79 patients had received or were receiving experimental treatment with LB-100.

In May 2025, the Company updated the safety overview of LB-100 and delivered the updated version 5.0 of the Investigator’s Brochure (the “IB”), which contains all of the relevant preclinical, clinical and pharmacologic data with respect to the study of the LB-100 clinical compound in humans, to the investigators of all ongoing clinical trials. The investigators of the study in colorectal cancer (NCT06012734) submitted a detailed response to the IRB, including the updated IB. The Company is currently awaiting the outcome of the IRB review.

Risks Related to this Offering and Ownership of our Securities

We have a history of losses, expect to continue to incur losses in the near term and may not achieve or sustain profitability in the future, and as a result, our management has identified, and our auditors agreed that there is a substantial doubt about our ability to continue as a going concern.

We have incurred significant losses since our inception. We experienced net losses of $3,585,965 and $5,087,029 for the years ended December 31, 2024 and 2023, respectively, and $709,555 and $971,322 for the three months ended March 31, 2025 and 2024, respectively. We expect our operating losses will continue, or even increase, at least through the near term. You should not rely upon our past results as indicative of future performance. We will not reach profitability in the near future or at any specific time in the future.

The report of our independent registered public accounting firm that accompanies our audited consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might result if we are unable to continue as a going concern. If we are unable to continue as a going concern, holders of our securities might lose their entire investment.

We are currently not in compliance with the Nasdaq Capital Market’s continued listing requirements. If we are unable to regain compliance with the Nasdaq Capital Market’s listing requirements, our securities could be delisted, which could affect our common stock’s market price and liquidity and reduce our ability to raise capital.

On August 19, 2024, we received a letter from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC indicating that we were not in compliance with the minimum stockholders’ equity requirement of $2,500,000 for continued listing on the Nasdaq Capital Market under Listing Rule 5550(b) (the “Equity Rule”).

On October 3, 2024, we submitted a plan to the Staff to regain compliance with the Equity Rule, which outlined our proposed initiatives to regain compliance by raising equity capital through various registered equity offerings.

On October 21, 2024, the Staff provided notice to us that it had granted an extension through February 18, 2025 to regain compliance with the Equity Rule.

As of February 18, 2025, we had not regained compliance with the Equity Rule. Accordingly, on February 19, 2025, we received a Staff determination letter from the Staff stating that we did not meet the terms of the extension because we did not complete our proposed financing initiatives to regain compliance. We timely requested a Hearing before a Nasdaq Hearings Panel (the “Panel”), which automatically stayed Nasdaq’s suspension or delisting of our Common Stock and public warrants pending the Panel’s decision.

On April 17, 2025, we received notice that the Panel had granted us an extension in which to regain compliance with all continued listing rules of the Nasdaq Capital Market. The Panel’s determination followed a hearing on April 3, 2025, at which time the Panel considered our plan to regain compliance with the Equity Rule. As a result of the extension, the Panel granted our request for continued listing on the Nasdaq Capital Market, provided that we demonstrate compliance with the Equity Rule and all other continued listing requirements for the Nasdaq Capital Market by July 3, 2025.

| 17 |

This offering is being conducted in order for us to satisfy the decision of the Panel and to provide the working capital resources to fund our operations. However, there can be no assurances that the Panel will deem the proceeds from this offering as sufficient to comply with the Equity Rule and all other continued listing requirements for the Nasdaq Capital Market. Accordingly, even if we complete this offering, there can be no assurances that we will be able to regain compliance during the extension period and thus be able to maintain our listing on the Nasdaq Capital Market.

During the extension period, our Common Stock and public warrants will continue to trade on the Nasdaq Capital Market.

We cannot assure you that we will be able to regain compliance with the Nasdaq Capital Market’s listing standards. Our failure to continue to meet these requirements would result in our common stock being delisted from Nasdaq, and if our common stock is delisted, the warrants issued in our public offering would also be delisted. We and holders of our securities could be materially adversely impacted if our securities are delisted from the Nasdaq Capital Market. In particular:

| ● | we may be unable to raise equity capital on acceptable terms or at all; | |

| ● | we may lose the confidence of our clinical partners, which would jeopardize our ability to continue our clinical trials as currently conducted; | |

| ● | the price of our common stock will likely decrease as a result of the loss of market efficiencies associated with the Nasdaq Capital Market and the loss of federal pre-emption of state securities laws; | |

| ● | holders may be unable to sell or purchase our securities when they wish to do so; | |

| ● | we may become subject to stockholder litigation; | |

| ● | we may be unable to attract, or we may lose the interest of, institutional investors in our common stock; | |

| ● | we may lose media and analyst coverage; | |

| ● | our common stock could be considered a “penny stock”, which would likely limit the level of trading activity in the secondary market for our common stock; and | |

| ● | we would likely lose any active trading market for our common stock, as it may only be traded on one of the over-the-counter markets, if at all. |

We will have to seek to raise additional funds to fund our operations, including the various clinical trials being currently conducted or will be conducted in the future. Depending on the terms available to us, if these fund raising activities result in significant dilution, they may negatively impact the trading price of our common stock.

Any additional financing that we secure may require the granting of rights, preferences or privileges senior to, or pari passu with, those of our common stock. Any issuances by us of equity securities may be at or below the prevailing market price of our common stock and in any event may have a dilutive impact on your ownership interest, which could cause the market price of our common stock to decline. We may also raise additional funds through the incurrence of debt or the issuance or sale of other securities or instruments senior to our shares of common stock, which may be highly dilutive. The holders of any securities or instruments we may issue may have rights superior to the rights of our common stockholders. If we experience dilution from the issuance of additional securities and we grant superior rights to new securities over holders of our common stock, it may negatively impact the trading price of our common stock and you may lose all or part of your investment.

As part of the Company’s ongoing process of evaluating various alternatives to obtain the capital required to fund its operations and maintain its listing on the Nasdaq Capital Market, management may decide to consider a wide variety of strategic alternatives, and there can be no assurances that any such transaction, if implemented, would enhance stockholder value, and could be highly dilutive to existing stockholders.

| 18 |

The Company is evaluating various alternatives to obtain the capital required to fund its operations and maintain its listing on the Nasdaq Capital Market, including merger or acquisition opportunities (including reverse mergers) and funding transactions involving a change in control. There can be no assurances that the evaluation process will result in the identification of an appropriate transaction, the negotiation and execution of a definitive agreement to effect such a transaction, or that any such transaction will ultimately be approved by the Company’s stockholders and then be consummated. Depending on various factors, many of which are outside the control of the Company, our failure to enter into and consummate a strategic transaction could have a material adverse effect on our ability to continue to operate and finance our business, and on the market price of our common stock. Even if such a strategic transaction is consummated, there can be no assurances that it will enhance stockholder value, and it may result in substantial dilution to existing stockholders. Any potential transaction would be dependent on a number of factors that may be outside of our control, including, among other things, market conditions, industry trends, the interest of third parties in a potential transaction with the Company, and the availability of appropriate financing for such a transaction. If we are unable to raise the required capital to fund our operations, or to enter into a strategic transaction in the near future, we may not be able to maintain our listing on the Nasdaq Capital Market, and we may need to curtail or cease operations, which could result in a total loss of stockholders’ investment.

The price of our common stock might fluctuate substantially.

You should consider an investment in our common stock to be risky. Some factors that might cause the market price of our common stock or public warrants to fluctuate, in addition to the other risks mentioned in this “Risk Factors” section, are:

| ● | sale of our common stock by our stockholders, executives, and directors and our stockholders; | |

| ● | volatility and limitations in trading volumes of our shares of common stock; | |

| ● | our ability to obtain financings to conduct and complete research and development activities including, but not limited to, our clinical trials, and other business activities; | |

| ● | the timing and success of introductions of new products by us or our competitors or any other change in the competitive dynamics of our industry, including consolidation among competitors, customers or strategic partners; | |

| ● | network outages or security breaches; | |

| ● | our ability to secure resources and the necessary personnel to conduct clinical trials on our desired schedule; | |

| ● | commencement, enrollment or results of our clinical trials for our lead product candidate or any future clinical trials we might conduct; | |

| ● | changes in the development status of our lead product candidate; | |

| ● | any delays or adverse developments or perceived adverse developments with respect to the FDA’s review of our planned preclinical and clinical trials; | |

| ● | any delay in our submission for studies or product approvals or adverse regulatory decisions, including failure to receive regulatory approval for our lead product candidate; | |

| ● | unanticipated safety concerns related to the use of our lead product candidate; | |

| ● | failures to meet external expectations or management guidance; | |

| ● | changes in our capital structure or dividend policy, future issuances of securities, sales of large blocks of common stock by our stockholders; | |

| ● | our cash position; |

| 19 |

| ● | announcements and events surrounding financing efforts, including debt and equity securities; | |

| ● | our inability to enter into new markets or develop new products; | |

| ● | reputational issues; | |

| ● | competition from existing technologies and products or new technologies and products that might emerge; | |