DEF 14A: Definitive proxy statements

Published on May 25, 2021

| UNITED STATES | |||

| SECURITIES AND EXCHANGE COMMISSION | |||

| Washington, D.C. 20549 | |||

| SCHEDULE 14A | |||

|

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. __) |

|||

| Filed by the Registrant [X] | |||

| Filed by a party other than the Registrant [ ] | |||

| Check the appropriate box: | |||

| [ ] | Preliminary Proxy Statement | ||

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| [X] | Definitive Proxy Statement | ||

| [ ] | Definitive Additional Materials | ||

| [ ] | Soliciting Material under §240.14a-12 | ||

| LIXTE BIOTECHNOLOGY HOLDINGS, INC. | |||

| (Name of Registrant as Specified in Its Charter) | |||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| Payment of Filing Fee (Check the appropriate box): | |||

| [X] | No fee required. | ||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| [ ] | Fee paid previously with preliminary materials. | ||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

Lixte Biotechnology Holdings, Inc.

248 Route 25A, No. 2

East Setauket, New York 11733

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 8, 2021

May 25, 2021

To the stockholders of Lixte Biotechnology Holdings, Inc.:

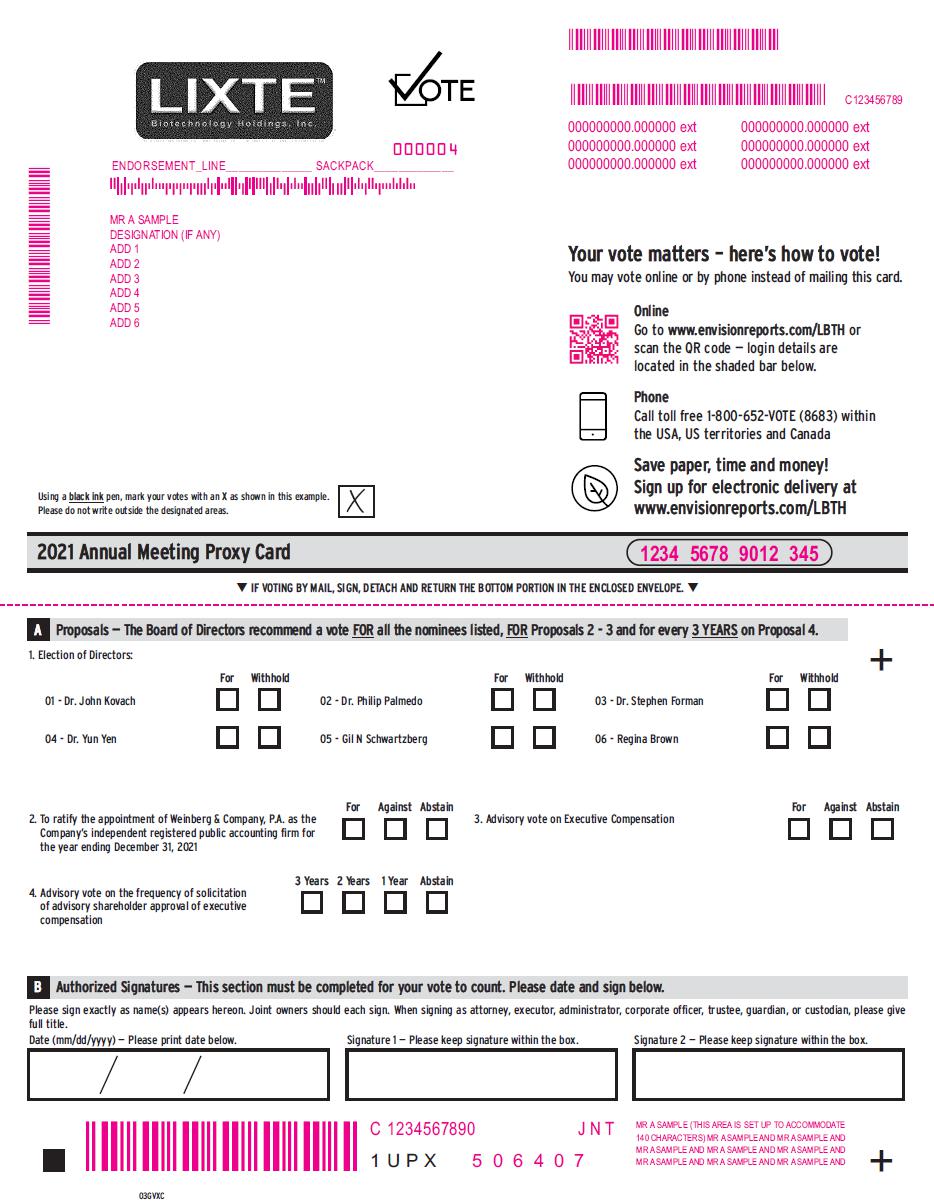

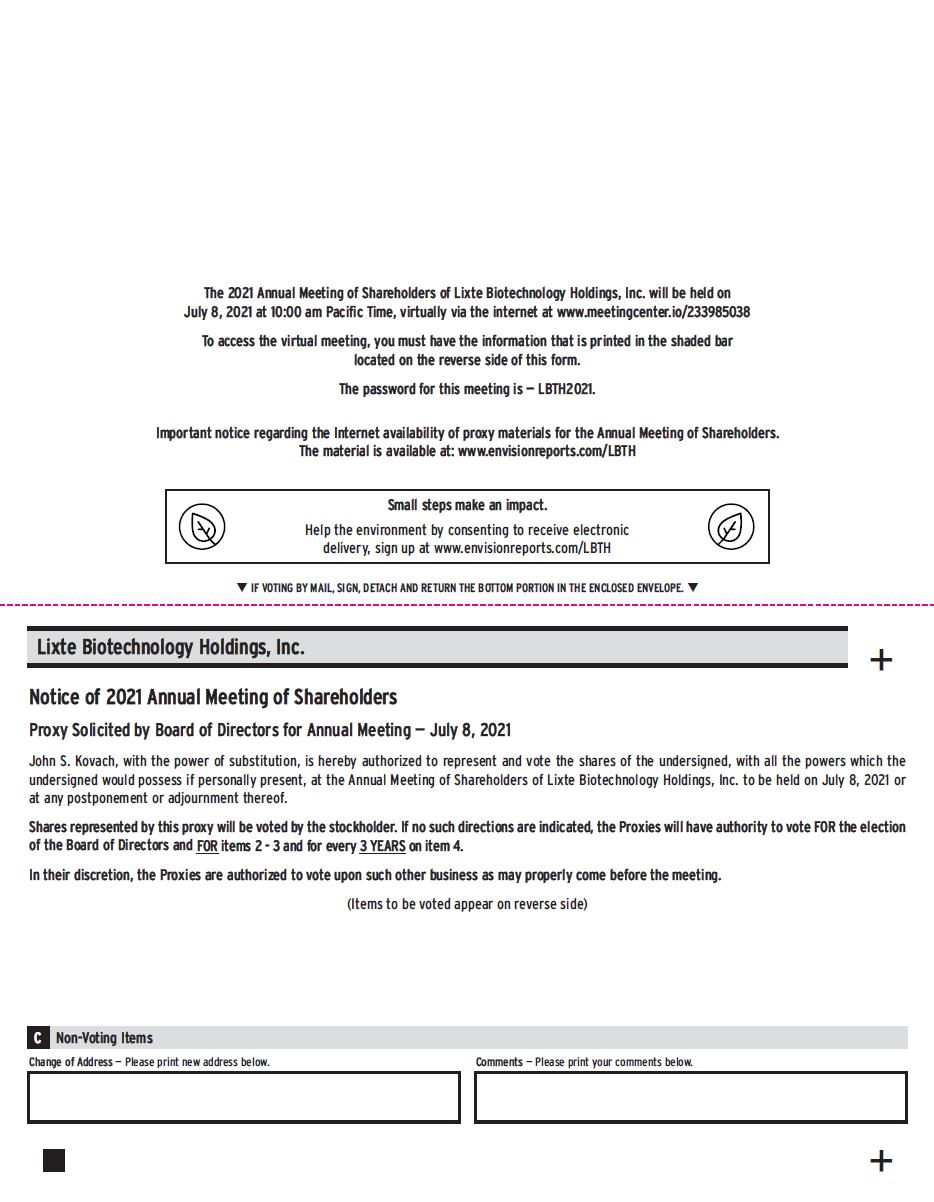

Notice is hereby given that the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Lixte Biotechnology Holdings, Inc., a Delaware corporation (“we,” “us,” “our,” “Lixte,” or the “Company”) will be held on July 8, 2021, at 10:00 a.m. Pacific Time. You are being asked to vote on the following matters:

| (1) |

To elect the six nominees for director named herein;

|

|

| (2) |

To ratify the appointment of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the year ending December 31, 2021;

|

|

|

(3)

|

To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement;

|

|

| (4) |

To indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of the Company’s named executive officers; and

|

|

| (5) | To transact other business that may properly come before the meeting and any postponement(s) or adjournment(s) thereof. |

The accompanying proxy statement contains additional information and should be carefully reviewed by stockholders.

Because of the COVID-19 pandemic, the Annual Meeting will be a completely virtual meeting of stockholders, conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online and vote your shares electronically by visiting: www.meetingcenter.io/233985038 at the meeting date and time described in the accompanying proxy statement. The password for the meeting is LBTH2021. There is no physical location for the Annual Meeting. We are utilizing the latest technology to provide safe access for our stockholders. Hosting a virtual meeting will enable greater stockholder attendance and participation from any location. Questions related to the Annual Meeting or voting matters can be submitted by email to Info@Lixte.com. We encourage you to attend online and participate. We recommend that you log in a few minutes before the Annual Meeting start time of 10:00 a.m. Pacific Time on July 8, 2021, to ensure you are logged in when the Annual Meeting begins.

Pursuant to the bylaws of the Company, the Board of Directors has fixed the close of business on May 20, 2021 as the record date (the “Record Date”) for determination of stockholders entitled to notice and to vote at the Annual Meeting and any adjournment thereof. Holders of the Company’s Common Stock are entitled to vote at the Annual Meeting.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide our beneficial owners and stockholders of record access to our proxy materials over the Internet. Beneficial owners are stockholders whose shares are held in the name of a broker, bank or other agent (i.e., in “street name”). Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed on or about May 25, 2021 to our beneficial owners and stockholders of record who owned our Common Stock at the close of business on May 20, 2021. Beneficial owners and stockholders of record will have the ability to access the proxy materials on a website referred to in the Notice or request a printed set of the proxy materials be sent to them by following the instructions in the Notice. Beneficial owners and stockholders of record who have previously requested to receive paper copies of our proxy materials will receive paper copies of the proxy materials instead of a Notice.

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

| /s/ John S. Kovach | |

| Chief Executive Officer |

|

Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the proxy mailed to you, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

|

| 2 |

| 3 |

Lixte Biotechnology Holdings, Inc.

248 Route 25A, No. 2

East Setauket, New York 11733

PROXY STATEMENT

FOR

2021 ANNUAL MEETING OF STOCKHOLDERS

JULY 8, 2021

The enclosed proxy is solicited by the Board of Directors (“Board of Directors” or “Board”) of Lixte Biotechnology Holdings, Inc. (the “Company”), in connection with the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company, to be held on July 8, 2021, at 10:00 a.m. Pacific Time via live webcast at www.meetingcenter.io/233985038 due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our stockholders, employees, management and directors.

At the Annual Meeting, you will be asked to consider and vote upon the following matters:

| (1) |

To elect the six nominees for director named herein;

|

| (2) |

To ratify the appointment of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the year ending December 31, 2021;

|

| (3) |

To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement;

|

| (4) |

To indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of the Company’s named executive officers; and

|

|

(5)

|

To transact other business that may properly come before the meeting and any postponement(s) or adjournment(s) thereof. |

The Board of Directors has fixed the close of business on May 20, 2021 as the record date (the “Record Date”) for determining stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide our beneficial owners and stockholders of record access to our proxy materials over the Internet. Beneficial owners are stockholders whose shares are held in the name of a broker, bank or other agent (i.e., in “street name”). Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed on or about May 25, 2021 to our beneficial owners and stockholders of record who owned our Common Stock at the close of business on May 20, 2021. Beneficial owners and stockholders of record will have the ability to access the proxy materials on a website referred to in the Notice or request a printed set of the proxy materials be sent to them by following the instructions in the Notice. Beneficial owners and stockholders of record who have previously requested to receive paper copies of our proxy materials will receive paper copies of the proxy materials instead of a Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JULY 8, 2021: THE NOTICE, PROXY STATEMENT, PROXY CARD AND THE ANNUAL REPORT ARE AVAILABLE AT WWW.LIXTE.COM, INVESTOR RELATIONS SECTION.

| 4 |

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive in the mail a Notice of Internet Availability of Proxy Materials this year instead of a full set of Proxy Materials?

We are pleased to take advantage of the SEC rule that allows companies to furnish their proxy materials over the Internet. Accordingly, we have sent to our beneficial owners and stockholders of record a Notice of Internet Availability of Proxy Materials. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the Notice. Our stockholders may request to receive proxy materials in printed form by mail or electronically on an ongoing basis. A stockholder’s election to receive proxy materials by mail or electronically by email will remain in effect until the stockholder terminates its election.

We intend to mail the Notice on or about May 25, 2021 to all stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after June 1, 2021.

How can I attend the Annual Meeting?

In light of the COVID-19 pandemic, to support the health and well-being of our stockholders, employees and directors, and taking into account recent federal, state and local guidance, the Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held. You will be able to attend the Annual Meeting online by visiting www.meetingcenter.io/233985038. You also will be able to vote your shares online by attending the Annual Meeting by webcast. Questions related to the Annual Meeting or voting matters can be submitted by email to Info@Lixte.com.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. The password for the meeting is LBTH2021. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The online meeting will begin promptly at 10:00 a.m. Pacific Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

How do I register to attend the Annual Meeting virtually on the Internet?

If you are a registered stockholder (i.e., you hold your shares through our transfer agent, Computershare Trust Company, N.A.), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the notice or proxy card that you received. Registered stockholders can attend the meeting by accessing the meeting site at www.meetingcenter.io/233985038 and entering the 15-digit control number that can be found on your Notice or proxy card mailed with the proxy materials and the meeting password, LBTH2021.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet. To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Lixte Biotechnology Holdings, Inc. holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Pacific Time on July 1, 2021. You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

By email

Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com.

By mail

Computershare

Lixte Biotechnology Holdings, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

| 5 |

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on May 20, 2021 will be entitled to vote at the Annual Meeting. On this record date, there were 13,663,260 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on May 20, 2021 your shares were registered directly in your name with the Company’s transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted. Registered stockholders can attend the meeting by accessing the meeting site at www.meetingcenter.io/233985038 and entering the 15-digit control number that can be found on your Notice or proxy card mailed with the proxy materials and the meeting password, LBTH2021.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on May 20, 2021 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are four matters scheduled for a vote:

● To elect the six nominees for director named herein;

● To ratify the appointment of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the year ending December 31, 2021;

● To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement; and

● To indicate, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of the Company’s named executive officers.

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How Do I Vote?

You may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

| 6 |

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote at the Annual Meeting or vote by proxy using the enclosed proxy card. Alternatively, you may vote by proxy either by telephone or on the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote even if you have already voted by proxy.

● To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

● To vote over the telephone, dial toll-free 1-800-652-VOTE (1-800-652-8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 5:00 p.m. Pacific Time on July 7, 2021 to be counted.

● To vote through the internet, go to www.envisionreports.com/LBTH to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your internet vote must be received by 5:00 p.m. Pacific Time on July 7, 2021 to be counted.

● To vote during the Annual Meeting, follow the instructions posted at www.meetingcenter.io/233985038.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions from that organization rather than from the Company. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

What if I have technical difficulties or trouble accessing the virtual Annual Meeting?

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. A link on the meeting page will provide further assistance should you need it or you may call 1-800-652-8683.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of May 20, 2021.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (“NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on Proposal 1, Proposal 3 or Proposal 4 without your instructions, but may vote your shares on Proposal 2 even in the absence of your instruction. Because NYSE rules apply to all brokers that are members of the NYSE, this prohibition applies to the Annual Meeting even though our common stock is listed on the Nasdaq Stock Market.

| 7 |

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all six nominees for director, “For” the proposal to ratify the appointment of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the year ending December 31, 2021, “For” to approve the compensation of named executive officers and for “One Year” as the preferred frequency of advisory votes to approve executive compensation. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

● You may submit another properly completed proxy card with a later date.

● You may grant a subsequent proxy by telephone or through the internet.

● You may revoke your proxy by telephone or through the internet.

● You may vote during the Annual Meeting, which will be hosted via the Internet.

Your most current proxy card or telephone or internet proxy will be the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s Annual Meeting?

Since we did not have an annual meeting last year, to be considered for inclusion in the Company’s proxy materials for next year’s annual meeting, your proposal (including a director nomination) must be submitted in writing, to Lixte Biotechnology Holdings, Inc., ATTN: Secretary, at 248 Route 25A, No. 2, East Setauket, New York 11733 a reasonable time before the date for such meeting. We will provide advance notice of the date in our quarterly report on Form 10-Q as soon as we determine that date together with a deadline date for submitting proposals. You are also advised to review the Company’s Bylaws, which contain additional requirements relating to advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to Proposal 2 and Proposal 3, votes “For” and “Against,” and abstentions. Abstentions will be counted towards the vote total for Proposal 2 and Proposal 3 and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

| 8 |

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How Many Votes Are Needed for Each Proposal to Pass?

| Proposal | Vote Required for Approval | Effect of Abstention | Effect of Broker Non-Vote | |||

|

Election of six members to our Board of Directors

|

Plurality of the votes cast (the six directors receiving the most “For” votes)

|

None | None | |||

|

Ratification of the Appointment of Weinberg & Company, P.A. as our Independent Registered Public Accounting Firm for our Fiscal Year Ending December 31, 2021

|

“For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter | Against |

Not applicable (1) |

|||

| Approval, on an advisory basis, of the compensation of the Company’s named executive officers | “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter | Against | None | |||

| Advisory vote on the frequency of shareholder advisory votes on executive compensation | The frequency receiving the votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter; however, in the event that no frequency receives a majority, we will consider whichever frequency receives a plurality of the votes to be the frequency preferred by the stockholders | Against | None |

(1) This proposal is considered to be a “routine” matter under NYSE rules. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority under NYSE rules to vote your shares on this proposal.

Vote cast online during the virtual Annual Meeting will constitute votes cast in person at the Annual Meeting for purposes of the votes.

What Constitutes a Quorum?

To carry on business at the Annual Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote, as of the Record Date, are represented in person or by proxy. Virtual attendance at the Annual Meeting constitutes presence in person for purposes of a quorum at the meeting. Thus, holders representing at least 6,831,631 votes must be represented in person or by proxy to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by us are not considered outstanding or considered to be present at the Annual Meeting. If there is not a quorum at the Annual Meeting, our stockholders may adjourn the meeting.

How can I find out the Results of the Voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K, which we will file within four business days of the meeting.

| 9 |

ELECTION OF DIRECTORS

Each director to be elected at the Annual Meeting will serve until the next annual meeting of stockholders and until his or her successor is elected, or, if sooner, until such director’s death, resignation or removal. Unless otherwise instructed, the persons named in the accompanying proxy intend to vote the shares represented by the proxy for the election of the six nominees listed below. Although it is not contemplated that any nominee will decline or be unable to serve as a director, in such event, proxies will be voted by the proxy holder for such other persons as may be designated by the Board of Directors, unless the Board of Directors reduces the number of Directors to be elected. Election of a director to the Board of Directors requires a plurality of the votes cast at the Annual Meeting.

The current Board of Directors consists of Dr. John Kovach, Dr. Philip Palmedo, Dr. Stephen Forman, Dr. Yun Yen, Gil N Schwartzberg, and Regina Brown. The Board of Directors has determined that a majority of its members, including Dr. Palmedo, Dr. Forman and Dr. Yen, and Ms. Brown are independent directors within the meaning of the applicable Nasdaq rules.

The following table sets forth the director nominees. It also provides certain information about the nominees as of the Record Date.

Nominees for Election to Board of Directors

| Director | ||||||||

| Name | Age | Since | ||||||

| Dr. John Kovach | 84 | 2005 | ||||||

| Dr. Philip Palmedo | 86 | 2006 | ||||||

| Dr. Stephen Forman | 72 | 2016 | ||||||

| Dr. Yun Yen | 65 | 2018 | ||||||

| Gil N Schwartzberg | 78 | 2021 | ||||||

| Regina Brown | 57 | 2021 | ||||||

Dr. John S. Kovach

Dr. John S. Kovach founded the Company in August 2005 and is our President, Chief Executive Officer, Chief Scientific Officer and a member of our Board of Directors. He received a B.A. (cum laude) from Princeton University and an M.D. (AOA) from the College of Physicians & Surgeons, Columbia University. Dr. Kovach trained in Internal Medicine and Hematology at Presbyterian Hospital, Columbia University and spent six years in the laboratory of Chemical Biology at the National Institute of Arthritis and Metabolic diseases studying control of gene expression in bacterial systems.

Dr. Kovach was recruited to the State University of New York at Stony Brook (“SUNY – Stony Brook”) in Stony Brook, New York in 2000 to found the Long Island Cancer Center (now named the Stony Brook University Cancer Center). From 1994 to 2000, Dr. Kovach was Executive Vice President for Medical and Scientific Affairs at the City of Hope National Medical Center in Los Angeles, California. His responsibilities included oversight of all basic and clinical research initiatives at the City of Hope. During that time, Dr. Kovach was also Director of the Beckman Research Center at City of Hope and a member of the Arnold and Mabel Beckman Scientific Advisory Board in Newport Beach, California.

From 1976 to 1994, Dr. Kovach was a consultant in oncology and director of the Cancer Pharmacology Division at the Mayo Clinic in Rochester, Minnesota. During this time, he directed the early clinical trials program for evaluation of new anti-cancer drugs as principal investigator of contracts from the National Cancer Institute. From 1986 to 1994, he was also Chair of the Department of Oncology and Director of the NCI-designated Mayo Comprehensive Cancer Center. During that time, Dr. Kovach, working with a molecular geneticist, Steve Sommer, M.D., Ph.D., published extensively on patterns of acquired mutations in human cancer cells as markers of environmental mutagens and as potential indicators of breast cancer patient prognosis. Dr. Kovach has published over 100 articles on the pharmacology, toxicity and effectiveness of anti-cancer treatments and on the molecular epidemiology of breast cancer.

| 10 |

Effective February 23, 2017, Dr. Kovach retired from his part-time (50%) academic position at SUNY – Stony Brook, as a result of which he has been devoting 100% of his time to our business activities since that date.

We believe that Dr. Kovach’s qualifications to sit on the Board include his extensive medical and research experience and, as founder and Chief Executive Officer of the Company, his deep knowledge of the Company’s compounds and science.

Dr. Philip F. Palmedo

Philip F. Palmedo, Ph.D., is a physicist, entrepreneur and corporate manager. Dr. Palmedo joined our Board of Directors on June 30, 2006. He founded and served as Chairman of the International Resources Group (IRG), an international consultancy in energy, natural resources and economic development. IRG was bought by L3 Communications in 2008. Dr. Palmedo designed and was the first President of the Long Island Research Institute formed by Brookhaven National Laboratory, Cold Spring Harbor Laboratory, and SUNY – Stony Brook to facilitate the commercialization of technologies. In 1988, Dr. Palmedo joined in the formation of Kepler Financial Management, Ltd., a quantitative financial research and trading company. He was President and Managing Director until 1991, when Renaissance Technologies Corporation acquired the company.

Dr. Palmedo served on the boards of Asset Management Advisors, the Teton Trust Company, EHR Investments and C-Quest Capital, and is currently a member of the Board of Directors of Gyrodyne LLC. He also served on the Board of Trustees of Williams College and of the Stony Brook (University) Foundation, where he chaired the Foundation’s Investment Committee.

We believe that Dr. Palmedo’s qualifications to sit on the Board include his extensive business, financial advisory and operational experience.

Dr. Stephen J. Forman

Stephen J. Forman, M.D., is an internationally recognized expert in hematologic malignancies and bone marrow transplantation and is a leader in preclinical and clinical cancer research. He is co-editor of Thomas’ Hematopoietic Cell Transplantation, a definitive textbook for clinicians, scientists and health care professionals. Dr. Forman is the Francis and Kathleen McNamara Distinguished Chair in Hematology and Hematopoietic Cell Transplantation at the City of Hope Comprehensive Cancer Center, a position he has held since 1987.

In nearly 40 years at City of Hope, Dr. Forman has been instrumental in advancing the survival rates for patients suffering from cancers of the blood and immune system such as leukemia, lymphoma and myeloma.

As Director of the T Cell Immunotherapy Research Laboratory, his current research is focused on cancer immunotherapy, using the body’s own immune system to attack cancer. Pharmacological enhancement of patients’ immune responses to their cancers is of special interest to us as the enzyme target of its lead clinical compound, LB-100, has been reported recently to be critical to immune function. Much of Dr. Forman’s current work centers on T cells and their cancer-fighting potential.

We believe that Dr. Forman’s qualifications to sit on the Board include his extensive medical and research experience principally at the City of Hope, one of the nation’s leading biomedical research and treatment institutions.

Dr. Yun Yen

Yun Yen, M.D., Ph.D., F.A.C.P. is a physician, scientist, innovator, and philanthropist. He is widely regarded as an expert in ribonucleotide reductase, a critical target in cancer therapy and diagnostics. He is President Emeritus of Taipei Medical University (TMU) and Chair Professor of the Ph.D. Program for Cancer Biology and Drug Discovery. Prior to TMU, Dr. Yen was the Allen and Lee Chao Endowed Chair in Developmental Cancer Therapeutics, Chair of Molecular Pharmacology Department, Associate Director for Translational Research, and Co-Director of the Developmental Cancer Therapeutics Program at the City of Hope NCI-designated Comprehensive Cancer Center, Duarte California. He has published more than 300 peer-reviewed articles, holds over 60 patents, and has commercialized multiple methodologies involving nanoparticles, small and large molecule drugs, biomarkers, stem cells, and medical devices. Dr. Yen also founded philanthropic organizations aimed at serving the global cancer community and holds membership in numerous professional societies. He serves on the boards of Fulgent Genetics and Tanvex BioPharma Inc.

We believe that Dr. Yen’s qualifications to sit on the Board include his extensive medical and research experience.

| 11 |

Gil N Schwartzberg

Gil N Schwartzberg, JD, ScD (hon) has been a consultant to the Company since its inception. Previously he was the Chairman of the Board, President and CEO of the City of Hope National Medical Center, one of the nation’s leading biomedical research and treatment facilities and a National Cancer Institute (NCI) Comprehensive Cancer Center. Following his departure, the Graduate School of Biological Science of The Beckman Research Institute at the City of Hope awarded him the degree of Doctor of Science, honoring his work in the advancement of science through programmatic development and the growth of the Graduate School. This was the first ScD. degree awarded by the Beckman Graduate School., which received its full academic accreditation during Mr. Schwartzberg’s tenure as the school’s president. He is now City of Hope Chairman Emeritus for life.

Prior to his joining the City of Hope Mr. Schwartzberg was Vice Chairman of the Board of Sterling Bank of Los Angeles, of which he was a founder and where he served for many years as the Chairman of the Loan Committee until the bank’s sale. Additionally, he was a founding shareholder of Skechers USA, Inc. (NYSE: SKX). He is currently a consultant to Skechers and both trustee and co-trustee of trusts that hold the controlling interest in the company.

Mr. Schwartzberg earned a Juris Doctorate awarded magna cum laude. He practiced law, specializing in business structure and transactions and remains a member in good standing of the California Bar, He is the author of two books. Warning Toxic Business Mistakes and How to Avoid Making Them and Jane Austen’s Persuasion Annotated, a Royal Navy Reading Companion.

We believe that Mr. Schwartzberg’s qualifications to sit on the Board include his extensive business and management experience as well as his background as Chairman of the Board and Chief Executive officer of City of Hope, one of the nation’s leading biomedical research and treatment institution.

Regina Brown

Regina Brown has been a practicing accountant for over 30 years. Currently, her practice has a wide range of clients, varying in size, industry and geographic locations. They include large national corporations listed on the New York Stock Exchange, as well as local Southern California businesses. Other clients consist of professionals, wholesalers, and high net worth individuals. Many of her clients have international and cross-border operations.

As a consequence of her depth of experience, she regularly assists other professionals with their client’s issues and performs tax research and analysis in connection with litigation and other matters including marital dissolution, tax and accounting with respect to mergers and acquisitions, implementation of internal controls, and extensive work in the area of trusts and estates. In addition, international tax matters and compliance have become a significant part of her practice. Ms. Brown is a member in good standing of the California Society of CPAs and the American Institute of Certified Public Accountants and has appeared as a speaker before both.

We believe that Ms. Brown’s qualifications to sit on the Board include her extensive accounting and business experience.

Director Compensation

Under our non-employee Director Compensation policy, the following compensation has been adopted for the outside directors:

Cash Compensation (payable quarterly):

Base director compensation - $20,000 per year

Chairman of audit committee - additional $10,000 per year

Chairman of any other committees - additional $5,000 per year

Member of audit committee - additional $5,000 per year

Member of any other committees - additional $2,500 per year

| 12 |

Equity Compensation:

Appointment of new director – options for 250,000 shares of common stock, exercisable at closing market price on date of grant for a period of five years, vesting 50% on the grant date and the remainder vesting 12.5% on the last day of each subsequent calendar quarter-end until fully vested.

Annual grant of stock options to outside directors (commencing during calendar 2021) – options to purchase 100,000 shares of common stock at the closing market price on the earlier of the date of the annual meeting of shareholders or the last business day of the month ending June 30, vesting 12.5% on the last day of each subsequent calendar quarter-end until fully vested.

The following table provides information concerning compensation of our non-employee directors who were directors during the fiscal years ended December 31, 2020, 2019 and 2018.

Director Compensation Table

|

Name and Principal Position |

Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) (1) | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||||

| John S. Kovach | 2020 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Director (2) | 2019 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| 2018 | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||

| Philip F. Palmedo | 2020 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Director | 2019 | - | - | - | 47,265 | - | - | - | 47,265 | |||||||||||||||||||||||||||

| 2018 | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||

| Stephen J. Forman | 2020 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Director | 2019 | - | - | - | 47,265 | - | - | - | 47,265 | |||||||||||||||||||||||||||

| 2018 | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||

| Winson Sze Chun Ho (3) | 2020 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Director | 2019 | - | - | - | 47,265 | - | - | - | 47,265 | |||||||||||||||||||||||||||

| 2018 | - | - | - | 52,460 | - | - | - | 52,460 | ||||||||||||||||||||||||||||

| Yun Yen | 2020 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Director | 2019 | - | - | - | 47,265 | - | - | - | 47,265 | |||||||||||||||||||||||||||

| 2018 | - | - | - | 52,460 | - | - | - | 52,460 | ||||||||||||||||||||||||||||

| (1) | Consists of grant date fair value of option award calculated pursuant to the Black-Scholes option-pricing model. |

| (2) | Dr. Kovach is also the Company’s President and Chief Executive Officer. |

| (3) | Dr. Ho resigned from the Board of Directors on April 9, 2021. |

Family Relationships

Eric Forman, our appointed Chief Administrative Officer, is the son of board member Dr. Stephen Forman and son-in-law of our director Gil Schwartzberg. Julie Forman, the wife of Eric Forman and the daughter of Gil Schwartzberg, is Vice President of Morgan Stanley Wealth Management, where the Company’s cash is deposited and the Company maintains a continuing banking relationship.

| 13 |

Involvement in Certain Legal Proceedings

During the past ten years, none of our officers, directors, promoters or control persons have been involved in any legal proceedings as described in Item 401(f) of Regulation S-K.

VOTE REQUIRED

Under applicable Delaware law, the election of each nominee requires the affirmative vote by a plurality of the voting power of the shares present and entitled to vote on the election of directors at the Annual Meeting at which a quorum is present.

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEES NAMED ABOVE AS DIRECTORS, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Code of Business Conduct and Ethics

The Board has established a corporate Code of Business Conduct and Ethics that applies to all officers, directors and employees and which is intended to qualify as a “code of ethics” as defined by Item 406 of Regulation S-K of the Exchange Act. The Code of Business Conduct and Ethics is available on the Investor Relations section of the Company’s website at www.Lixte.com. If the Company makes any substantive amendments to the Code of Business Conduct and Ethics or grants any waiver from a provision of the Code to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

Public Availability of Corporate Governance Documents

Our key corporate governance documents, including our Code of Conduct and the charters of our Audit Committee and Compensation Committee are:

● available on the Investor Relations section of our corporate website at www.Lixte.com; and

● available in print to any stockholder who requests them from our corporate secretary.

Director Attendance

The Board held five meetings during 2020. Each director attended at least 75% of Board meetings and meetings of the committees on which he served.

Board Qualification and Selection Process

Our entire Board of Directors serves in place of a Nominating and Corporate Governance Committee. The Board does not have a specific written policy or process regarding the nominations of directors, nor does it maintain minimum standards for director nominees or consider diversity in identifying nominees for director. However, the Board does consider the knowledge, experience, integrity and judgment of potential candidates for nominations to the Board. The Board will consider persons recommended by stockholders for nomination for election as directors. The Board will consider and evaluate a director candidate recommended by a stockholder in the same manner as a Board-recommended nominee. Stockholders wishing to recommend director candidates must follow the prior notice requirements as described herein.

| 14 |

Board Leadership Structure and Risk Oversight

The leadership of the Board of Directors is currently structured so that it is led by the Company’s Chief Executive Officer, Dr. John Kovach, who presides over meetings of the Board of Directors and sets meeting agendas and determines materials to be distributed to the Board of Directors.

The Board of Directors has determined that, given the size and current state of the Company’s operations, this leadership structure is in the best interests of the Company and the Company’s stockholders.

The entire Board of Directors, as well as through its various committees, is responsible for oversight of our Company’s risk management process. Management furnishes information regarding risk to the Board of Directors as requested. The Audit Committee discusses risk management with the Company’s management and independent public accountants as set forth in the Audit Committee’s charter. The Compensation Committee reviews the compensation programs of the Company to make sure economic incentives are tied to the long-term interests of the stockholders. The Company believes that innovation and the building of long-term stockholder value are impossible without taking risks. We recognize that imprudent acceptance of risk and the failure to identify risks could be a detriment to stockholder value. The executive officers of the Company are responsible for assessing these risks on a day-to-day basis and for how to best identify, manage and mitigate significant risks that the Company may face.

Board Committees

The Board has established an Audit Committee and a Compensation Committee. For the fiscal year ended December 31, 2020, Dr. Philip Palmedo, Dr. Yun Yen, and Dr. Winson Sze Chun Ho served on the Audit Committee, with Dr. Palmedo serving as Chairman. Dr. Ho resigned from the Board on April 8, 2021 and was replaced on the Audit Committee by Dr. Stephen Forman. On May 11, 2021, Dr. Forman resigned from the Audit Committee and was replaced by Regina Brown. For the fiscal year ended December 31, 2020, Dr. Philip Palmedo, Dr. Stephen Forman and Dr. Yun Yen served on the Compensation Committee, with Dr. Yen serving as Chairman.

The following is a description of each of the committees and their composition:

Audit Committee

Our audit committee is responsible for, among other things:

| ● | Approving and retaining the independent auditors to conduct the annual audit of our financial statements; | |

| ● | reviewing the proposed scope and results of the audit; | |

| ● | reviewing and pre-approving audit and non-audit fees and services; |

| ● | reviewing accounting and financial controls with the independent auditors and our financial and accounting staff; | |

| ● | reviewing and approving transactions between us and our directors, officers and affiliates; | |

| ● | establishing procedures for complaints received by us regarding accounting matters; | |

| ● | overseeing internal audit functions, if any; and | |

| ● | preparing the report of the audit committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

| 15 |

Our audit committee currently consists of Dr. Philip Palmedo, Dr. Yun Yen and Regina Brown, with Ms. Brown serving as chair. Our Board of Directors has affirmatively determined that each of the committee members meet the definition of “independent director” under the Nasdaq rules, and that they meet the independence standards under Rule 10A-3. Each member of our audit committee meets the financial literacy requirements of the Nasdaq rules. In addition, our Board of Directors has determined that Regina Brown qualifies as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. Our Board of Directors has adopted a written charter for the audit committee, which is available on our principal corporate website at www.lixte.com.

Report of the Audit Committee of the Board of Directors

This report of the audit committee is required by the SEC and, in accordance with the SEC’s rules, will not be deemed to be part of or incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act, or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed “soliciting material” or “filed” under either the Securities Act or the Exchange Act.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2020 with management of the Company. The Audit Committee has discussed with the Company’s independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

Submitted by:

The Audit Committee of

The Board of Directors

Philip Palmedo (Chairman)

Stephen Forman

Yun Yen

Compensation Committee

Our compensation committee is responsible for, among other things:

| ● | reviewing and recommending the compensation arrangements for executive management; | |

| ● | establishing and reviewing general compensation policies with the objective to attract and retain superior talent, to reward individual performance and to achieve our financial goals; | |

| ● | administering our stock incentive plans; and | |

| ● | preparing the report of the compensation committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our compensation committee consists of Dr. Yun Yen, Dr. Stephen Forman and Dr. Philip Palmedo, with Dr. Yen serving as chairman. Our Board of Directors has determined that all three committee members are independent directors under Nasdaq rules. Our Board of Directors has adopted a written charter for the compensation committee, which is available on our principal corporate website at www.lixte.com.

| 16 |

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is an officer or employee of the Company. None of the executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the Board or Compensation Committee.

Compensation Committee Report

This report of the Compensation Committee is required by the SEC and, in accordance with the SEC’s rules, will not be deemed to be part of or incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended (“Securities Act”), or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed “soliciting material” or “filed” under either the Securities Act or the Exchange Act.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis contained in this proxy statement with management. Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

Submitted by:

The Compensation Committee of

The Board of Directors

Dr. Yun Yen (Chairman)

Dr. Stephen Forman

Dr. Philip Palmedo

Stockholder Communication

Any stockholder may communicate in writing by mail at any time with the entire Board of Directors or any individual director (addressed to “Board of Directors” or to a named director), c/o Lixte Biotechnology Holdings, Inc., ATTN: Secretary, 248 Route 25A, No. 2, East Setauket, New York 11733. All communications will be compiled by the Secretary of the Company and promptly submitted to the Board of Directors or the individual directors on a periodic basis.

Policy Regarding Attendance at Annual Meetings of Stockholders

The Company does not have a policy with regard to the attendance of Board members at annual meetings.

Director Independence

As required under the Nasdaq Stock Market listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board of Directors consults with the Company’s counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board of Directors has affirmatively determined that the following directors are independent directors within the meaning of the applicable Nasdaq listing standards: Dr. Philip Palmedo, Dr. Stephen Forman, Dr. Yun Yen and Regina Brown.

| 17 |

RATIFICATION OF THE APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Weinberg & Company, P.A. (“Weinberg”) to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2021 and our Board of Directors has further directed that management submit the selection of its independent registered public accountant firm for ratification by the stockholders at the Annual Meeting. Weinberg has audited the Company’s financial statements since 2013. Representatives of Weinberg are not expected to be present at the Annual Meeting.

Stockholder ratification of the selection of Weinberg as the Company’s independent registered public accountants is not required by Delaware law, the Company’s certificate of incorporation, or the Company’s bylaws. However, the Audit Committee is submitting the selection of Weinberg to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent registered public accountants at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of Weinberg. Abstentions will be counted toward the tabulation of votes cast on Proposal 2 and will have the same effect as negative votes. Broker non-votes will be counted towards a quorum, but will not be counted for any purpose in determining whether Proposal 2 has been approved.

Audit Fees

The following table sets forth aggregate fees billed to us by Weinberg & Company, P.A., our independent registered public accounting firm during the fiscal years ended December 31, 2020 and December 31, 2019.

| Years Ended December 31, | ||||||||

| 2019 | 2020 | |||||||

| Audit Fees(1) | $ | 75,491 | $ | 78,567 | ||||

| Audit-Related Fees(2) | — | — | ||||||

| Tax Fees(3) | 18,260 | 14,134 | ||||||

| Other Fees(4) | — | 71,537 | ||||||

| Total | $ | 93,751 | $ | 164,238 | ||||

| (1) | Audit fees represent fees for professional services provided in connection with the audit of our annual financial statements included in our Annual Reports on Form 10-K and the review of our interim financial statements included in our Quarterly Reports on Form 10-Q and services that are normally provided in connection with statutory or regulatory filings, excluding those fees included in Other Fees. |

| (2) | Audit-related fees represent fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and not reported above under “Audit Fees.” |

| (3) | Tax fees represent fees for professional services related to tax compliance, tax advice and tax planning. |

| (4) | Other fees represent fees incurred with respect to our Registration Statement on Form S-1, which was declared effective by the U.S. Securities and Exchange Commission on November 24, 2020. |

All audit and audit-related services, tax services and other services rendered by Weinberg & Company, P.A. during the fiscal years ended December 31, 2019 and 2020 were pre-approved by our Board of Directors. The Board of Directors has adopted a pre-approval policy that provides for the pre-approval of all services performed for us by our independent registered public accounting firm.

Policy for Pre-Approval of Independent Auditor Services

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by Weinberg. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the specific service or category of service and is generally subject to a specific budget. The independent auditor and management are required to periodically communicate to the Audit Committee regarding the extent of services provided by the independent auditor in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

THE BOARD RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF WEINBERG & COMPANY, P.A. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

| 18 |

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and Section 14A of the Exchange Act entitle the Company’s stockholders to vote to approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement (including the compensation tables, and the narrative disclosures that accompany the compensation tables) pursuant to the SEC’s rules. This Annual meeting will be the first opportunity for our stockholders to indicate their preference as to when the Company should solicit a non-binding advisory vote on the compensation of the named executive officers, commonly referred to as a “say-on-pay vote,” every three years. The Board of Directors has adopted a policy that solicitation of the “say-on-pay” vote should be every three years. In accordance with that policy, this year, the Company is asking the stockholders to approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement in accordance with SEC rules.

The Company’s executive compensation programs are designed to (1) motivate and retain executive officers, and (2) align executive officers’ interests with those of the Company’s stockholders. Please read the section herein entitled “Executive Compensation” for additional details about the Company’s executive compensation programs, including information about the fiscal year 2020 compensation of the Company’s named executive officers.

The Compensation Committee continually reviews the compensation programs for the Company’s executive officers to ensure they achieve the desired goals of aligning the Company’s executive compensation structure with the Company’s stockholders’ interests and current market practices.

The Company is asking its stockholders to indicate their support for the Company’s named executive officer compensation as disclosed in this Proxy Statement. This proposal, commonly known as a “say-on-pay” proposal, gives the Company’s stockholders the opportunity to express their views on the Company’s executive compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers described in this Proxy Statement. Accordingly, the Company will ask its stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the compensation paid to Lixte Biotechnology Holdings, Inc.’s named executive officers, as disclosed in the Company’s Proxy Statement for the 2021 Annual Meeting of Stockholders pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

The say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or the Company’s Board of Directors. The Company’s Board of Directors and Compensation Committee value the opinions of the Company’s stockholders and to the extent there is any significant vote against the named executive officer compensation as disclosed in this Proxy Statement, the Company will consider its concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns. Unless the Board of Directors decides to modify its policy regarding the frequency of soliciting advisory votes on the compensation of the Company’s named executives, and depending on the results of the vote for Proposal 4 at the Annual Meeting the next scheduled say-on-pay vote will be at the 2024 Annual Meeting of Stockholders.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS, AS STATED IN THE ABOVE NON-BINDING RESOLUTION, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

| 19 |

ADVISORY VOTE ON THE FREQUENCY OF SOLICITATION OF

ADVISORY SHAREHOLDER APPROVAL OF EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act, and Section 14A of the Exchange Act also enable the Company’s stockholders, at least once every six years, to indicate their preference regarding how frequently the Company should solicit a non-binding advisory vote on the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement. The Company is asking stockholders to indicate whether they would prefer an advisory vote every year, every other year or every three years. Alternatively, stockholders may abstain from casting a vote. For the reasons described below, the Board recommends that the stockholders select a frequency of every three years.

The Board is asking stockholders to indicate their preferred voting frequency by voting for one, two or three years or abstaining from voting on this proposal. While the Board believes that its recommendation is appropriate at this time, the stockholders are not voting to approve or disapprove that recommendation, but are instead asked to indicate their preferences, on an advisory basis, as to whether the non-binding advisory vote on the approval of the Company’s executive officer compensation practices should be held every year, every other year or every three years. The option among those choices that receives votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on this matter at the Annual Meeting will be deemed to be the frequency preferred by the stockholders; however, in the event that no frequency receives a majority, the Board will consider whichever frequency receives a plurality of the votes to be the frequency preferred by the stockholders. Abstentions will have the same effect as votes “Against” each of the proposed voting frequencies. Broker non-votes will have no effect.

The Board and the Compensation Committee value the opinions of the stockholders in this matter, and the Board intends to hold say-on-pay votes in the future in accordance with the alternative that receives the most stockholder support, even if that alternative does not receive the support of a majority of the shares present and entitled to vote. However, because this vote is advisory and, therefore, not binding on the Board of Directors or the Company, the Board may decide that it is in the best interests of the stockholders that the Company hold an advisory vote on executive compensation more or less frequently than the option preferred by the stockholders. The vote will not be construed to create or imply any change or addition to the fiduciary duties of the Company or the Board.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE IN FAVOR OF “THREE YEARS” ON PROPOSAL 4.

| 20 |

Officers

The names of our officers and their ages, positions, and biographies are set forth below. Dr. John Kovach’s background is discussed under the section Nominees for Election to Board of Directors. The persons listed below served as our officers during 2020:

| Name | Age | Position | ||

| Dr. John S. Kovach | 84 | President, Chief Executive Officer, Chief Scientific Officer, and Chairman of the Board of Directors | ||

| Dr. James S. Miser. | 73 | Chief Medical Officer | ||

| Robert N. Weingarten | 69 | Vice President and Chief Financial Officer | ||

| Eric J. Forman | 41 | Chief Administrative Officer |

Dr. James S. Miser

James S. Miser, M.D., is a pediatric hematologist/oncologist, internationally recognized as an expert in the study and treatment of childhood cancers. His outstanding career includes leadership positions as Clinical Director, Department of Pediatrics, Division of Pediatric Hematology/Oncology, Children’s Hospital and Medical Center and Associate Member, Fred Hutchinson Cancer Research Center, Seattle, Washington; Chairman, Division of Pediatrics, Director, Department of Pediatric Hematology/Oncology, President and Chief Executive Officer, and Chief Medical Officer, all at City of Hope National Medical Center, Duarte, California. Since 2009, he has been a member of the Active Staff, Department of Pediatrics at City of Hope, most recently part-time, and Chair Professor, College of Medical Sciences and Technology, Taipei Medical University, Taipei, Taiwan.

Dr. Miser has extensive experience in the clinical development of new anti-cancer drugs for pediatric malignancies, leading many clinical trials at institutional and national cancer study groups. He is expert in the design and monitoring of clinical cancer trials and was a member of the Soft Tissue Sarcoma Strategy Group, and Member of the New Agents Executive and Steering Committee, Phase II Coordinator Children’s Cancer Group and Chairman, Data Monitoring Committee, National Wilms Tumor Society. He has authored more than a 100 peer reviewed articles dealing primarily with pediatric clinical cancer studies.

Robert N. Weingarten

We have entered into an Employment Agreement with Mr. Weingarten to serve as our Vice President and Chief Financial Officer effective August 12, 2020. Mr. Weingarten is an experienced business consultant and advisor with a consulting practice focusing on accounting and SEC compliance issues. Since 1979, Mr. Weingarten has provided such financial consulting and advisory services, has acted as chief financial officer, and has served on the boards of directors of numerous public companies in various stages of development, operation or reorganization. Mr. Weingarten has experience in a variety of industries, including the pharmaceutical industry.

| 21 |

Mr. Weingarten has been a Director of Guardion Health Sciences, Inc. since June 2015 and Chairman of its Board of Directors since July 2020. Previously, Mr. Weingarten served as Lead Director on Guardion’s Board of Directors from January 2017 to March 2020. From July 2017 to June 2018, Mr. Weingarten was the Chief Financial Officer of Alltemp, Inc. From April 2013 to February 2017, Mr. Weingarten served on the Board of Directors of RespireRx Pharmaceuticals Inc. and also served as its Vice President and Chief Financial Officer. Mr. Weingarten received a B.A. in Accounting from the University of Washington in 1974, a M.B.A. in Finance from the University of Southern California in 1975, and is a Certified Public Accountant (inactive) in the State of California.

Eric Forman, J.D.

Mr. Forman has led our business development as a consultant since 2013. Effective as of October 1, 2020, Mr. Forman was appointed as our Chief Administrative Officer. In his capacity as a consultant, and in his role as Chief Administrative Officer, his responsibilities include overseeing all internal operations, the development of science/business collaborations, and the management of our growing intellectual property portfolio. Prior to his involvement with our company, he served as Counsel and Senior Project Manager at Shore Group Associates managing in-house legal, tax, and regulatory affairs and supervising client relations for financial software and mobile application development teams.

As an attorney, Mr. Forman has represented and advised both technology and biotechnology companies, entrepreneurs, non-profits, and start-ups with a focus on intellectual property, licensing, corporate structure and transactions.

Mr. Forman earned a B.A. degree Cum Laude from Loyola Marymount University and a J.D. from the Benjamin N. Cardozo School of Law. He has an active law license and is a member of the New York State Bar Association.

EXECUTIVE OFFICERS AND MANAGEMENT COMPENSATION

Compensation Discussion and Analysis

The following discussion and analysis of compensation arrangements of our named executive officers for 2020 should be read together with the compensation tables and related disclosures set forth below.

We believe our success is driven by the leadership of our named executive officers. Our named executive officers are primarily responsible for many of our important business development relationships. The growth and maintenance of these relationships is critical to ensuring our future success, as is experience in managing these relationships. Therefore, it is important to our success that we retain the services of these individuals. Our Board believes that our current executive compensation program properly aligns the interests of our executive officers with those of our stockholders.

General Philosophy

Our overall compensation philosophy is to provide an executive compensation package that enables us to attract, retain and motivate executive officers to achieve our near-term and long-term business objectives. We also believe that a meaningful portion of the executive officer’s total cash compensation should be at risk and dependent upon the achievement of our objectives. Among other things, our compensation philosophy aims to reward strong performance with competitive pay and thus better enable us to retain executive officers who contribute to the long-term success of the Company.

We attempt to pay our executive officers competitively in order to retain the most capable people in the industry. In making executive and employee compensation decisions, the Compensation Committee considers achievement of certain goals and criteria, some of which relate to the Company’s performance and others to the performance of the individual employee.

| 22 |

The Compensation Committee periodically evaluates our compensation policies to determine whether we remain competitive among industry peers and continue to attract, retain and motivate key personnel. To meet these objectives, the Compensation Committee may from time to time increase salaries, award additional equity grants or provide other short and long-term incentive compensation. Our Board of Directors values the perspective of our stockholders, and the Compensation Committee will continue to consider the outcome of future say-on-pay votes, as well as any other stockholder feedback, when making compensation decisions for the named executive officers.

The Compensation Committee generally seeks input from our executive officers when discussing the performance and compensation levels for executives and other Company leadership. The Compensation Committee also works with our Chief Executive Officer and Chief Financial Officer to evaluate the financial, accounting, tax and retention implications of our various compensation programs. No executive participates in deliberations relating to his or her own compensation.

The Compensation Committee will consider the results of the say-on-pay vote on our executive compensation program as part of its annual executive compensation review. Our Board of Directors values the opinions of our stockholders, and the Compensation Committee will continue to consider the outcome of future say-on-pay votes, as well as any feedback received, when making compensation decisions for the named executive officers.

Compensation Program and Forms of Compensation

We provide our executive officers with a compensation package which currently consists of base salary, , equity incentives and participation in benefit plans generally available to other employees. In establishing total compensation, the Compensation Committee considers individual and company performance, as well as market information regarding compensation paid by other companies in our peer group.

Base salaries are calculated to be competitive within our industry and to reflect the capabilities and experience of our executives. The equity awards incentivize executives to deliver long-term stockholder value, while serving as a retention vehicle for our executive talent.

The Compensation Committee conducts a risk assessment of the Company’s compensation practices to analyze whether they encourage employees to take excessive or inappropriate risks. After completing the review, the Compensation Committee has concluded that the Company’s compensation programs are, on balance, consistent with market practices and do not present material risks to the Company.

Hedging Policy

The Company has established an Insider Trading Policy, which, among other things, prohibits trading in securities with material nonpublic information including through hedging activities. Further, none of the Company’s employees, directors, consultants and contractors may trade in options, warrants, puts and calls or similar instruments on our securities or sell our securities “short”. Engaging in any transactions relating to our common stock must be pre-cleared by our Chief Financial Officer.

Tax and Accounting Considerations

Limitation on Deductibility of Executive Compensation